Meridian Compensation Partners reported on the current status of legislation at the state and local level seeking to impose some sort of penalty on companies based on their CEO/PEO (or deemed equivalent)/employee pay ratio (or some variation), with California reportedly being the latest and the only new jurisdiction to join the fray since last March via a proposed corporate income tax rate increase scaled to enumerated COO/median US employee pay ratio thresholds (as further detailed in the memo).

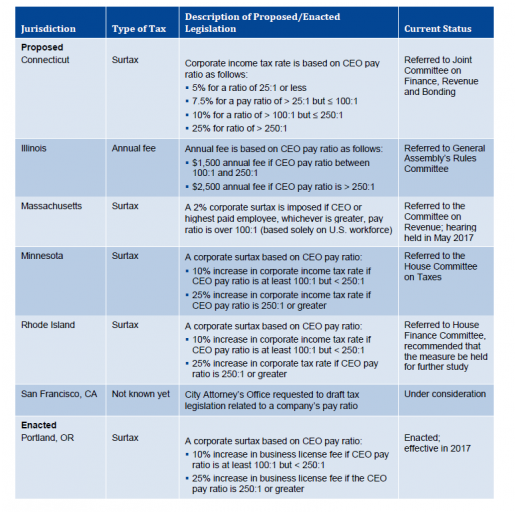

Other jurisdictions that have proposed or enacted a surtax or fee are depicted here:

Meridian projects that, fortunately - other than Portland, which already enacted legislation, the various proposals are unlikely to gain sufficient traction to become law due to insufficient legislative support.