Further to our recent report on Vanguard's updated proxy voting & engagement guidelines, Georgeson's must-read overview of the changes includes this information and advice in response to Vanguard's more stringent overboarding policy:

Georgeson has identified 230 NEOs who sit on more than two public company boards who are likely to be affected by this policy. Similarly, there are 142 non-executive directors who sit on more than four public company boards. Most of the affected directors and companies are likely not to have adequate time to address the overboarding issue for the current proxy season. The companies whose director(s) would run afoul of the above mentioned board limits should consider reaching out to Vanguard to communicate any potential reduction in board memberships that an affected director may be considering. The companies should also consider providing any information or context that would help explain or mitigate any overboarding concerns (which primarily relate to director effectiveness and ability to devote adequate time and attentiveness to each board position).

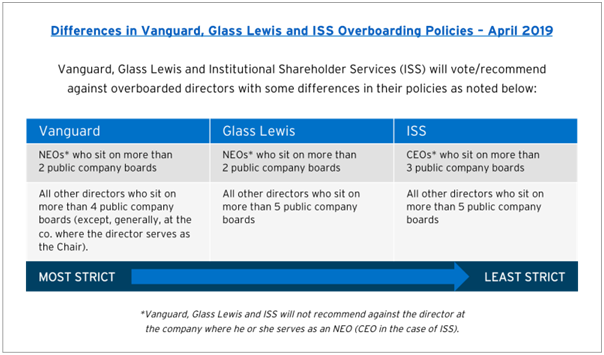

This graphic compares Vanguard's updated overboarding policy to Glass Lewis's and ISS's policies:

In this new PJT Camberview interview with Vanguard, Investment Stewardship Officer Glenn Booraem comments on the policy change:

While this is a change in our policy, our view is that this change should not come as a surprise to most companies. We have been clear about our view of the important role of directors in representing the interests of shareholders. This policy is intended to encourage those directors who may have a number of public company commitments to assess where they are adding the most value - it is not about replacing directors or disrupting sound corporate governance but rather finding ways to right size their workload.

Both informative publications address numerous other policy updates that - among other things - encompass a new scheme to escalate votes against directors/committees under enumerated circumstances including, e.g., failing to address "zombie" directors and board non-responsiveness to shareholder proposals, and greater insight into Vanguard's approach on E&S disclosure and policy/practice proposals.

Access additional information & resources on our Institutional Investors page. This post first appeared in the weekly Society Alert!