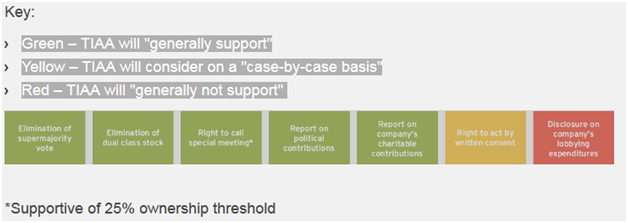

Georgeson's summary of TIAA's updated Responsible Investing Policy includes several informative graphics that express the investor's views on shareholder rights-related and ESG proposals:

Shareholder-rights related proposals:

ESG proposals (organized and color-coded by the four topics that TIAA believes companies should consider in their analyses & decision-making: Environmental | Customers | Employees & Suppliers | Communities) that TIAA will "generally support":

Notably, Georgeson indicates that TIAA's historical voting is consistent with its proxy guidelines, and that it eschews a one-size-fits-all approach in favor of company-specific analysis.

Notably, Georgeson indicates that TIAA's historical voting is consistent with its proxy guidelines, and that it eschews a one-size-fits-all approach in favor of company-specific analysis.

The updated Policy also informs on TIAA's responsible investing program and ESG approach generally, and includes recommended actions for company management and the board on each of the above four ESG topics.

Board recommendations include:

- Environment: Boards should guide the development of a strategic, long-term approach to addressing environmental risks and opportunities, and hold management accountable for its implementation.

- Customers: Boards should provide appropriate oversight and accountability over management to implement policies to manage/mitigate customer-related risks (e.g., product quality, compliance with product/service regulations) in a manner that upholds transparency and integrity with the company's customers.

- Employees & Suppliers: Boards should provide oversight of - and independent perspective on - the quality of management performance, compensation and succession planning, the overall talent pipeline and recruitment strategies, and other qualitative and quantitative performance characteristics associated with the company’s talent management strategies.

- Communities: Boards should approve and oversee the company's human rights policies and implementation frameworks; address management of human rights risks and opportunities at board meetings; and account for the company’s commitment to respecting human rights and the effectiveness of its risk frameworks via the board's oversight and management's disclosures.

Access additional information & resources on our Institutional Investors page. This post first appeared in the weekly Society Alert!