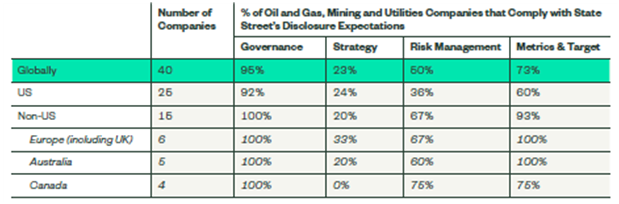

State Street's two-pronged analysis of the climate-related disclosures of 40 of the largest and highest profile oil & gas, mining, and utilities companies in its portfolio (identified in the Appendix) relative to the TCFD's Governance, Strategy, Risk Management, and Metrics & Targets recommendations revealed gaps between the investor's expectations and current practices, and suggested insights for companies to narrow the gaps:

1. Are Companies Disclosing the Information Investors Need to Make Informed Decisions?

2. What Can We Learn From Disclosures About the Current State of Climate Action?

Key takeaways:

- Governance

- Only 40% of US boards have a dedicated sustainability committee charged with overseeing the company’s response to climate or environmental risks; the remaining 60% assign this responsibility to a public policy, audit, or nom/gov committee.

- However, based on its engagement, State Street cautions investors from relying solely on the committee charter and name to understand the quality of board oversight on sustainability issues, having learned that director oversight and involvement in climate/environmental risks often extends beyond the committee charter even at companies without dedicated sustainability committees.

- Strategy

- Areas of opportunity for companies: Conducting scenario analysis to understand the risks and opportunities presented by climate change and the shift to a low-carbon economy, and disclosing to investors how this thinking shapes long-term strategic planning. Only 23% of companies provide some information on this topic, which purportedly tended to be high-level and of limited value to investors.

- Risk Management

- Only half of the companies disclose either an average carbon-price assumption or a range of carbon prices; no company discloses both. The broad range of assumptions among those that disclose this highlights the need for consensus about how companies should account for the externalities of their carbon emissions.

- Metrics & Targets

- Nearly 75% of companies globally have established and disclosed goals for managing GHG emissions from operations, but the time horizon of most of these goals is either one to three years or a 2020 target date — a period that is too short to drive meaningful change.

The report includes a handful of principles that State Street suggests should shape investor and company engagement on this topic.

See also our recent report: "State Street: Climate Change Risk Oversight Framework," and additional information & resources on our Sustainability/ESG and Institutional Investors pages. This post first appeared in the weekly Society Alert!