According to the results of Bank Director's recent survey of 348 independent US bank directors, CEOs, human resources officers, and other senior executives, nearly one-third of respondents' boards conduct an annual evaluation; however, results vary significantly by ownership structure - with 53% of publicly-traded banks (49% of total respondent group) saying their board conducts annual evaluations compared to 18% of privately held institutions (43% of total respondent group), and 42% of mutual banks (8% of total respondents). Of those that perform evaluations, 59% say they are used to identify underperforming or less engaged directors; 10% are unsure.

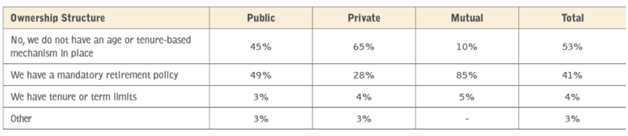

Additional noteworthy results include these stats on refreshment mechanisms:

Does the board have a mandatory retirement age or similar mechanism to open seats for new board members?

Nearly 60% of publicly traded respondents and 41% of private respondents said that their Nom/Gov Committee is working to recruit younger directors - with the top recruitment challenge across all ownership structures being prospective candidates' lack of necessary experience.

Respondent asset sizes ranged from <$250M to >$10B, with most falling in the $1B - $500M range, as detailed at the end of the report.

See the release, and access additional resources on our Board/Governance Practices, Director Compensation, and CEO Succession pages. This post first appeared in the weekly Society Alert!