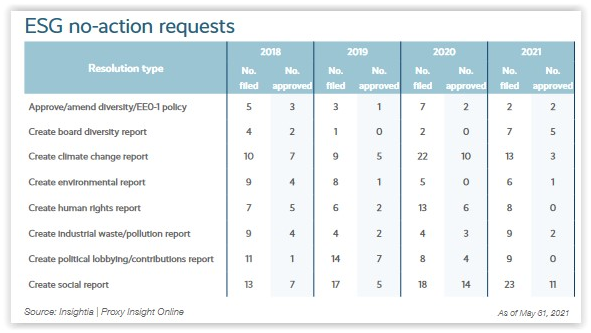

Proxy Insight’s “The ESG Floodgates Open” (page 5) discusses the significant impact on the disposition of shareholder proposal no-action requests associated with the recent change in SEC leadership and their approach toward analyzing environmental and social (E&S) issues under Rule 14a-8, which differs markedly from the previous administration. This table shows the change over the past four proxy seasons (through May 31, 2021) in the SEC staff’s grant or denial of no-action requests on E&S proposals:

As documented above, subject to contextual year-over-year changes in the numbers of proposals of each type filed:

As documented above, subject to contextual year-over-year changes in the numbers of proposals of each type filed:

- Approval of no-action requests pertaining to shareholder proposals requesting climate change reports declined from 45% in 2020 to 23% in 2021.

- Approval of no-action requests pertaining to shareholder proposals requesting human rights reporting declined from 46% in 2020 to zero this year.

- Approval of no-action requests pertaining to shareholder proposals requesting industrial waste/pollution reporting declined from 75% in 2020 to 22% this year.

- Approval of no-action requests pertaining to shareholder proposals seeking political lobbying/contributions reports fell from 50% in 2020 to zero this year.

- Approval of no-action requests pertaining to shareholder proposals requesting social issue reporting declined from 77% in 2020 to 48% this year.

Activist investor group and climate resolution proponent Follow This told Proxy Insight that “the regulator’s rejection of exclusion requests for shareholder proposals ‘indicates a shift at the SEC, allowing other investors to build on this decision and submit resolutions which the SEC had largely categorically rejected.’”

Access additional resources on our Proxy Season 2021 page.

This post first appeared in the weekly Society Alert!