Georgeson’s analysis of 351 of the 400 largest global institutional asset managers and owners globally as of year-end 2020 (“target investors”) revealed varying preferences on ESG data providers, reporting frameworks and standards, and engagement priorities.

Key takeaways include:

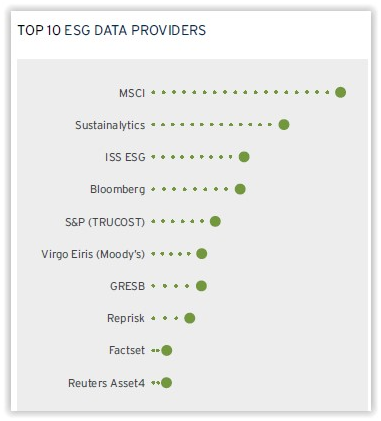

ESG raters - Investors disclosed their reliance on 39 unique ESG raters, with nearly 60% of the 79% of investors that disclosed specific information reporting their use of more than one provider. Based on investors' disclosures, MSCI, Sustainalytics, and ISS ESG, are most commonly used, as shown here:

In addition to or in lieu of third party ESG ratings providers, however, as previously reported (see, e.g., ”Study Shows Widespread Use of 3rd Party and Proprietary ESG Ratings”), investors are increasingly developing and using proprietary ESG ratings, with nearly 40% of the target investors, including Legal and General Investment Management and State Street Global Advisors, now having proprietary scoring systems.

In addition to or in lieu of third party ESG ratings providers, however, as previously reported (see, e.g., ”Study Shows Widespread Use of 3rd Party and Proprietary ESG Ratings”), investors are increasingly developing and using proprietary ESG ratings, with nearly 40% of the target investors, including Legal and General Investment Management and State Street Global Advisors, now having proprietary scoring systems.

Preferred reporting frameworks/standards - The top five frameworks and/or standards favored by target investors consist of CDP, GRI, IIRC, SASB, and the TCFD.

Topical E&S priorities - Of the 10 most commonly disclosed environmental stewardship priorities, climate change risk management, GHG emissions/carbon footprint, water management, and energy management/efficiency, are the most frequently cited topics. Of the 10 most commonly disclosed social stewardship priorities, human rights/child labor, D&I/HCM, employee health and safety, and bribery and corruption/ethics, are the most frequently cited topics.

Access additional information & resources on our Sustainability page.

This post first appeared in the weekly Society Alert!