Among the key takeaways from Shroders’ institutional investor sustainability survey of 750 institutional investors worldwide (27% North America) conducted in February/March 2021:

- The top driver of a sustainability investment focus for 54% of investors is to positively impact society and the planet through sustainable investments. A majority of investors (52%) cited alignment with corporate / internal values as a driver of their sustainability investment focus. Regulatory and industry pressure, and risk management, were identified by 43% and 42% of investors, respectively, as driving their sustainability focus. The potential for higher returns ranked #5 at 36%.

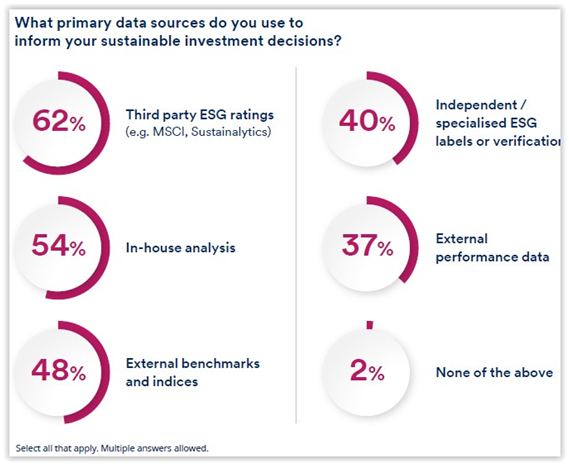

- Investors most commonly identified third party ESG ratings as their primary data source to inform their sustainable investment decisions, followed by in-house analysis and external benchmarks and indices, as shown here:

- Nearly 60% of investors identified greenwashing due to a lack of clear, agreed-upon definitions of “sustainable investment” as a chief challenge of sustainability investing; 53% cited lack of transparency and reported data; and nearly half (49%) identified the difficulty in measuring and managing risk.

The report notes regional variations where relevant.

See Shroders’ release; these articles from funds Europe and Corporate Secretary, and additional resources on our Sustainability and Institutional Investors pages.

This post first appeared in the weekly Society Alert!