“The General Counsel View of ESG Risk” from Stanford’s Rock Center for Corporate Governance reveals valuable insights about how companies’ general counsel and senior legal officers have been impacted by and view the “ESG movement” based on a recent survey.*

Among the key takeaways:

Internal & External pressures

Of those 78% of respondents who have been pressured in the last three years to increase their organization’s commitment to ESG, the primary sources of pressure have been employees (48%), large institutional investors (44%), and customers (41%). Relatedly, management teams of companies encountering pressure from employees, large institutional investors, and customers met with those groups 62%, 83%, and 59% of the time, respectively, to discuss their concerns illustrating a high level of responsiveness.

Top pressure points

Of the 80% of respondent companies pressured to increase their financial or organizational commitment to diversity, equity, and inclusion (DE&I), 96% responded with a significantly or somewhat increased commitment in this area. Of the 67% of respondent companies pressured to increase their financial or organizational commitment to environmental or sustainability matters (e.g., emissions, pollution, waste, or environmental stewardship), 97% responded with a significantly or somewhat increased commitment in this area.

Disclosure-related liability concerns

Half of respondents expressed concerns that disclosure of metrics relating to environmental issues would increase their companies’ legal or regulatory exposure; 42% expressed concern that disclosure of DE&I metrics would increase their exposure; and 27% expressed concern that disclosure of metrics relating to the societal impact of their companies’ products or services would increase their exposure.

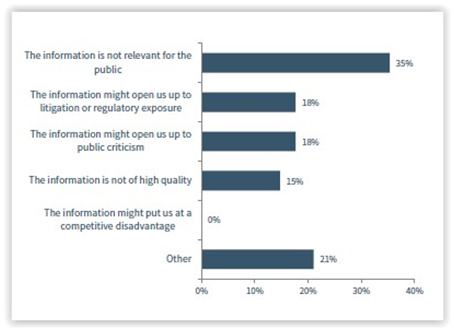

Of the 73% of respondents indicating that their company does not publicly disclose their DOL EEO-1 report, nearly 20% expressed concerns about litigation or regulatory exposure. The balance identified other reasons for not making this information publicly available:

CEO & Employee Activism

CEO & Employee Activism

- Over half of respondents would advise their CEO and board as a matter of policy to focus exclusively on their companies’ strategic and financial mission and only engage in policy issues directly related to that mission.

- More than one-third of respondents believe that a CEO who takes a public stance on environmental, societal, or political issues exposes the company to reputational, legal, or regulatory harm; another 29% were unsure.

- Nearly 90% said they believe the CEO should discuss with the board, and 93% said the CEO should discuss with the general counsel, the possible positive and negative consequences of taking a public stance on such matters before doing so.

* Survey respondents consisted of 69 general counsel and senior legal officers from public (68%) and private (32%) companies across sizes and industries.

See “General counsel have ESG jitters even as efforts increase” (Reuters); our recent report: “CEO/Corporate Activism Governance: Society Members Speak!” and additional resources on our Sustainability and Activism pages.

This post first appeared in the weekly Society Alert!