PwC's report on its "2021 Annual Corporate Directors Survey" of 851 public company directors (29% female/71% male) across industries reveals how board practices are evolving in response to changes in the macro environment and societal pressures in the context of efforts to remain focused on core oversight responsibilities.

Noteworthy findings include:

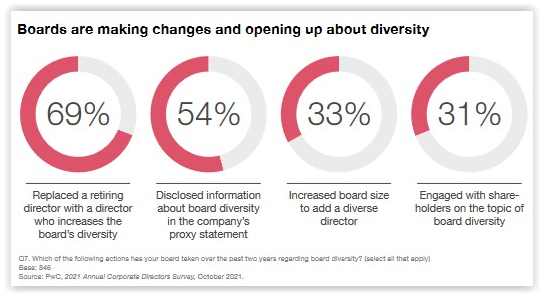

- Board diversity - More than 90% of directors said their board has taken actions over the past two years on board diversity, most commonly, replacing a retiring director with a diverse director, as shown here:

Racial/ethnic diversity was identified as the single most important attribute respondents’ boards will prioritize in their next director search, followed by industry expertise, operational expertise, and gender diversity.

- ESG - Most directors agree that ESG is linked to the company’s strategy (64%); is a part of the board's ERM discussions (62%); has a financial impact on the company’s performance (54%); and is regularly on the board’s agenda (52%). Just 18% of respondents believe mandatory ESG reporting/disclosure requirements would be preferable to the current voluntary disclosure approach (67%).

- Social purpose - 83% of directors very much or somewhat agree that social purpose and company profitability are not mutually exclusive.

- Virtual board/committee meetings - The majority of respondents said that the shift to virtual board/committee meetings positively impacted meeting efficiency; however, this comes at the expense of board culture, which most directors believe has been negatively impacted.

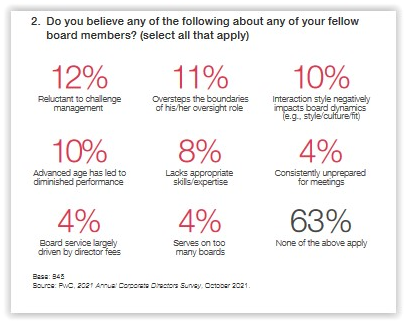

- Peer perceptions - Although 47% of respondents overall said that, in their opinion, at least one of their fellow directors should be replaced (compared to 49% last year), respondents' bases for criticism of fellow directors are extremely noteworthy for what they do NOT include:

- Board/director evaluations - 72% of respondents said their board made changes in response to their most recent evaluation process - most commonly by adding additional expertise to the board.

- Shareholder engagement - 53% of respondents said that a member of their board (other than the CEO) had direct engagement with investors during the past 12 months (12% were uncertain).

- Long-term COVID impacts - More than 90% of directors ranked employees' ability to work remotely as a long-term structural impact of COVID-19 on business in general. Reduced employee travel came in at a close second (88%).

There are a number of additional key findings relating to board diversity that are noteworthy, including the view among a majority of directors that while board diversity is being driven by political correctness, it brings unique perspectives to the boardroom, improves relationships with investors, and enhances board performance. Furthermore, directors commonly support policies to interview a diverse slate of candidates (e.g., the Rooney Rule) and to direct their search firms to offer a diverse slate of candidates, to achieve board diversity. Just one-third of directors (compared to 71% last year) believe that boards will naturally become more diverse over time without affirmatively taking actions to achieve it.

See these articles: “More Corporate Directors Welcome Rules to Boost Board Diversity” (Bloomberg) and “Corporate directors see ESG reporting as necessity” (Accounting Today), “PwC Survey: Boards Increasingly Linking ESG to Strategy, But Don’t Fully Grasp Risks” (ESG Today), and “Boards facing regulatory scrutiny intensify focus on ESG” (CFO Dive), and additional resources on our Board Practices/Governance Practices page.

This post first appeared in the weekly Society Alert!