“ESG Shareholder Engagement” from Corporate Secretary and IR Magazine presents the results of an online survey of investors (n=84), governance professionals (e.g., corporate secretaries, in-house counsel) (n=139), and investor relations professionals (n=153) conducted between July and September 2020.

Noteworthy results based on governance professional respondents (74% North America) include:

- The IR officer/IR team is most frequently involved in ESG engagement with investors, followed by in-house governance teams, ESG/sustainability teams, the CEO/CFO, board members, and HR. By company size, mid-caps reported the highest level of governance team engagement.

- Just over half of respondents said they engage with third-party experts who provide advice or guidance to board members on ESG matters. Not surprisingly, however, results varied significantly by company size, with 64% of mega-caps reporting use of third-party experts compared to about 25% of small-caps.

- Nearly 60% of respondents overall believe that their board has a high level of ESG oversight involvement. This is particularly the case at mid-cap and large-/mega-cap companies (65% - 71% of respondents) compared to just 38% of small-caps.

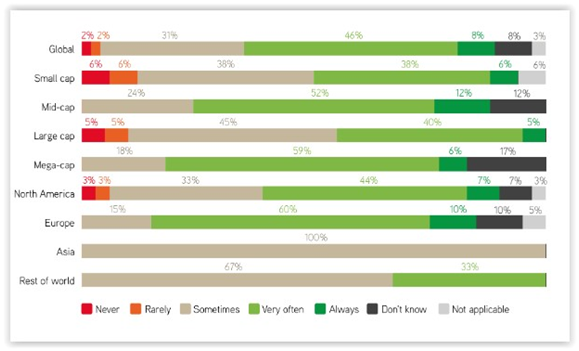

- More than half of North American respondents (governance professionals) said that ESG issues arise for discussion at board meetings very often or always, generally on par with the global average.

- Respondents reported investor focus in engagements over the past year on these topics (from most to least frequently cited): environmental issues, COVID-19, employee diversity data, board composition and effectiveness, and executive pay.

65% of North American respondents across company sizes said their company publishes an ESG report and 37% said that their board is considering linking a percentage of executive compensation to ESG metrics (see report on ESG metrics below).

Among IR respondents (40% North America), more than half (much more commonly, large-caps) said that their investors ask them to use a specific sustainability reporting framework and 70% said their company reports in accordance with one or more frameworks. The most commonly requested or used frameworks are SASB, GRI, TCFD, and CDP.

Among investor respondents, 80% of North American respondents reported ESG risks or opportunities being given more focus at their firm when making investment decisions in the last three years, which compares to 84% globally. Investors globally (33% North America) generally cited the same topics reported by governance professionals as prompting engagement, with the exception of more investors identifying supply-chain management issues as a key area of focus - much more so than employee diversity data.

Access additional resources on our Shareholder Engagement page.

This post first appeared in the weekly Society Alert!