As widely anticipated, at an open meeting today, the SEC proposed climate risk disclosure rules.

Based on the Fact Sheet, and the proposing release, the rule would require Form 10-K and registration statement disclosure of the following:

- How any climate-related risks identified by the company have had or are likely to have a material impact on its business and consolidated financial statements, which may manifest over the short-, medium-, or long-term (page 59 of the proposing release)

- How any identified climate-related risks have affected or are likely to affect the company’s strategy, business model, and outlook (page 76 of the proposing release)

- Disclosure about carbon offsets, renewable energy credits, internal carbon price, and scenario analysis, if used (page 82 of the proposing release)

- Governance-related disclosures relating to the board’s oversight of climate-related risks ad management’s role in assessing and managing the risks, including the board members or committees responsible for board oversight and any director climate expertise, and management positions or committees responsible for climate risk assessment and management (on par with the proposed cyber disclosure rule released March 9) (page 98 of the proposing release)

- The company’s processes for identifying, assessing, and managing climate-related risks and whether any such processes are integrated into the company’s overall risk management system or processes; (page 106 of the proposing release)

- If the company has adopted a transition plan as part of its climate-related risk management strategy, a description of the plan, including the relevant metrics and targets used to identify and manage any physical and transition risks (page 108 of the proposing release)

- The impact of climate-related events (severe weather events and other natural conditions) and transition activities on the line items of a company’s consolidated financial statements, as well as the financial estimates and assumptions used in the financial statements set (page 116 of the proposing release)

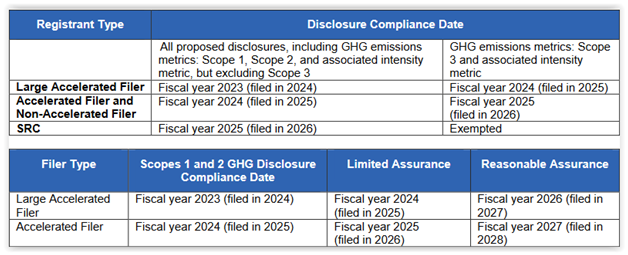

- The company’s Scope 1 and Scope 2 emissions, subject to a phase-in period based on filer status (see below), and subject to independent assurance for accelerated and large accelerated filers (see below) (pages 154+, 225 of the proposing release)

- Scope 3 emissions, if material, or if the company has set a Scope 3-related GHG emissions target or goal, subject to a safe harbor, a phase-in period based on filer status (see below), and an exemption for SRCs (page 154+ of the proposing release)

This table illustrates the phase-in periods for qualitative and quantitative disclosures and independent assurance assuming a December 2022 effective date of the rule and December 31 FYE:

If the company has publicly set climate-related targets or goals, the rule would also require disclosure about those targets or goals, including the scope of activities and emissions included in the target, the defined time horizon by which the target is intended to be achieved, and any interim targets; how the company intends to meet its climate-related targets or goals; and progress indicators (page 279 of the proposing release).

If the company has publicly set climate-related targets or goals, the rule would also require disclosure about those targets or goals, including the scope of activities and emissions included in the target, the defined time horizon by which the target is intended to be achieved, and any interim targets; how the company intends to meet its climate-related targets or goals; and progress indicators (page 279 of the proposing release).

PSLRA safe harbors would be available for forward-looking statements.

The comment letter deadline is the later of 60 days following publication of the proposing release on the SEC’s website (today) or 30 days following publication of the proposing release in the Federal Register. The Society plans to comment. Members interested in assisting with the comment letter should contact Kate Kelly at krkelly@fb.com or Ted Allen at tallen@societycorpgov.org.

See the SEC’s press release; these statements from SEC Chair Gary Gensler and Commissioners Lee, Crenshaw, and Peirce (dissenting); and additional resources on our Climate Risk & Disclosure page.