Public company finance, accounting, sustainability, and legal executives* responding to Deloitte’s Q4 2021 ESG survey provided insights on current and planned ESG disclosure and practices, challenges, and priorities.

Current practice takeaways include:

- Disclosure prevalence and medium - All respondents reported that their company is currently disclosing ESG performance – most commonly on sustainability or ESG web pages (54%), followed by (in descending order) stand-alone ESG reports (50%), unaudited disclosures within audit financial statements (43%), investor conferences (41%), analyst earnings calls (36%), unaudited sections of the financial statements (34%), and press releases (33%).

- Assurance - Among those who obtain assurance on their ESG disclosures, a plurality said they use their existing financial auditor (41%), followed closely by a different assurance provider (CPA/chartered accountant) (38%); 21% obtain assurance from non-CPA/chartered accountants (e.g., boutique firms). Assurance is most commonly obtained for DE&I (53%) and GHG (49%) data, followed by health and safety (44%), governance practices (40%), water and energy (each at 38%), and waste (36%).

- Frameworks & standards - Most companies use at least two frameworks/standards, with SASB and CDSB being the most common (each at 43%), followed by the TCFD (40%), GHG (38%), GRI (35%), and IIRC (32%).

- Stakeholder influence - Surprisingly, more respondents cited ESG rating agencies as influencing their ESG reporting and disclosure policy than any other stakeholder type, including customers, boards of directors, investors, government, NGOs, and employees.

- Governance - A majority of respondents (54%) said their executive leadership team is responsible for governance oversight, followed by an ESG/sustainability committee (41%), audit committee and nominating/governance committee (each at 39%), and the full board (37%).

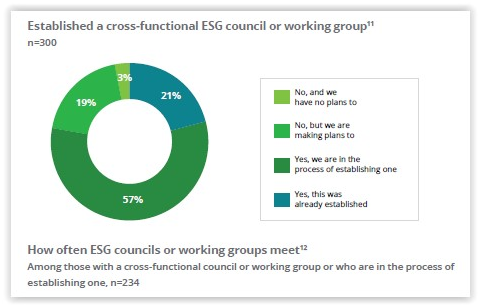

- Management/internal organization - Although just 21% said they have a cross-functional ESG council or working group, an additional 57% said they are in the process of establishing one and another nearly 20% said they are planning to do so.

Among those companies that have a cross-functional ESG council or working group or are in the process of establishing one, 50% meet (or plan to meet) quarterly, 36% monthly, 6% semiannually, and 8% more than monthly.

*Respondents consisted of 300 finance, accounting, sustainability, and legal executives. “Executives” is defined as senior finance and accounting executives with a minimum seniority of director or Chief Risk Officer, General Counsel, Chief Legal Officer, and Chief Sustainability Officer. Respondents reflect a cross-industry representation of US public companies with revenues greater than $500 million (75% of respondents represented companies with revenues exceeding $1 billion).

See this ESG Today article and additional resources on our Sustainability page.

This post first appeared in the weekly Society Alert!