Wilson Sonsini’s “2021 Silicon Valley 150 Corporate Governance Report” benchmarks numerous corporate governance practices and trends among the 150 largest Silicon Valley companies (based on sales) largely concentrated in the tech, biotech, and pharma industries.

Coverage includes:

- Boards and committees - board composition, tenure, and overboarding; board committee structure and size; board leadership; and the number of board and committee meetings

- Executive officers - how many; most common positions other than CEO & CFO; and female representation

- Defensive measures - classified boards; director removal requirements; majority or plurality vote standard; board authority to increase/decrease board size and fill vacancies; advance notice and proxy access bylaws; various stockholder rights (e.g., special meetings, written consent, amendment of charter/bylaws); poison pills; cumulative voting; capital structure

- Proxy statement disclosures - ESG; director skills matrix; board diversity; shareholder engagement; board evaluations; succession planning; cybersecurity; HCM; proxy statement summaries; meeting format

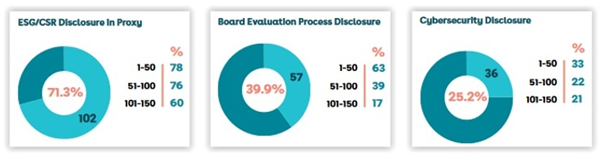

- Notably, with respect to nearly all disclosures benchmarked, a significantly higher percentage of the largest 50 companies (of 150 companies total) provided disclosure as compared to the smallest 50 companies, with the middle 50 falling somewhere in between, as illustrated here:

- Shareholder proposals - prevalence; most common topics

- Executive compensation - say-on-pay, CEO pay ratio; perks; clawback policy prevalence, triggers, and scope

See the key takeaways on page 42.

Access additional resources on our Board Practices/Governance Practices page.

This post first appeared in the weekly Society Alert!