Q4’s report: “ESG in the Boardroom: Getting oversight right” reveals the results of a recent survey of 210 corporate secretaries, assistant corporate secretaries, GCs, deputy GCs, and others*, about their companies’ ESG governance practices.

Among the key takeaways for North American companies:

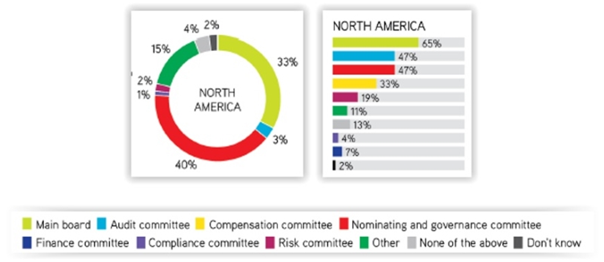

Oversight Structure - The nominating and governance committee has primary oversight of ESG issues, with the full board also retaining oversight responsibility at most companies, and the other key committees often assuming some oversight. The first graphic reflects primary oversight, and the second graphic reflects some oversight, of ESG issues.

Reporting cadence - Board committees with ESG oversight most commonly report to the full board on these issues on an ad-hoc basis (33%), followed by every board meeting (29%). Most companies (61%) reported a large increase in the frequency of full board discussion on ESG issues compared to three years ago.

Reporting cadence - Board committees with ESG oversight most commonly report to the full board on these issues on an ad-hoc basis (33%), followed by every board meeting (29%). Most companies (61%) reported a large increase in the frequency of full board discussion on ESG issues compared to three years ago.

Investor focus - More than half of companies said that investors have asked questions about the board’s governance structure and processes around ESG issues in the past 12 months, compared to just over one-third that have asked questions about board skills in relation to ESG issues.Board skills/expertise - A plurality of companies (43%) indicated that their board includes (43%), or plans to start including over the next year (14%), ESG considerations when recruiting new directors.Information sources - Nearly half (and the plurality) of companies identified the corporate secretary/governance team as the primary source of information on ESG issues (46%), followed by the company’s sustainability team (30%).Director participation in ESG engagement - Most companies (57%) involve their directors at least some of the time in their investor engagements on ESG issues; however, 38% never have directors participate, and 5% always do. The report also reveals worldwide responses by company size category.* Respondents represented primarily North American (~60%) and European (30%) companies - 39% mega- and large-cap, 19% mid-cap, and 30% small-cap.

This post first appeared in the weekly Society Alert!