Among the many noteworthy statistics and insights gleaned from Legal & General Investment Management's (LGIM) newly published annual Active Ownership Report:

Of 773 total engagements with 571 companies in 2021, 240 were in the UK, followed by North America at 176 engagements, with climate change being the #1 engagement topic (globally), followed (in descending order) by compensation, the company’s LGIM ESG score, and the company’s disclosure and transparency.

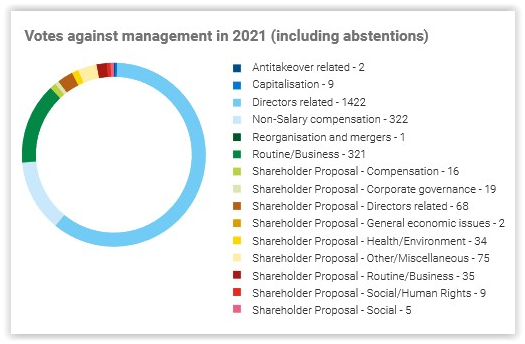

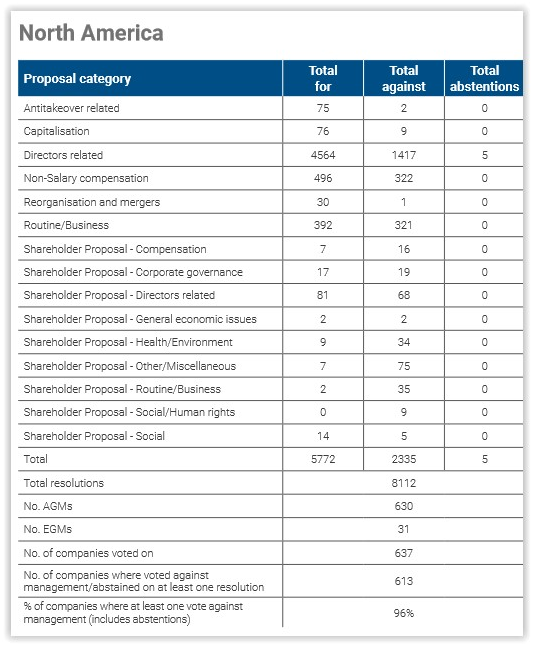

In North America specifically, LGIM voted at 637 companies and against management on at least one proposal at 96% of those (613 companies), which represents a significantly higher rate of “no” votes than any other region reported (p101). Director-related "no" votes accounted for the majority of "against" votes, as shown here:

In the US, LGIM voted against 240 directors with a combined chair/CEO role and supported 34 shareholder proposals to appoint an independent chair in furtherance of its global position (excluding only Japan based on market-specific particulars) that the roles should be split.

In the US, LGIM voted against 240 directors with a combined chair/CEO role and supported 34 shareholder proposals to appoint an independent chair in furtherance of its global position (excluding only Japan based on market-specific particulars) that the roles should be split.

Negative votes against directors in North America based on board gender diversity concerns increased from 31 directors in 2020 to 102 directors in 2021. LGIM also supported 94% of social, workplace, and political lobbying shareholder proposals across its portfolio, with the US comprising the “vast majority” of such proposals (p54).

Further to last year’s report regarding its proprietary ESG scoring system, LGIM indicates it added a 29th ESG metric to its scoring system dubbed “temperature alignment” (see the initial 28 metrics here on page 6), which is defined as “a forward-looking measure of a company’s carbon trajectory, designed to analyse the current and future emissions intensity from direct and indirect emissions.”

Further to last year’s report regarding its proprietary ESG scoring system, LGIM indicates it added a 29th ESG metric to its scoring system dubbed “temperature alignment” (see the initial 28 metrics here on page 6), which is defined as “a forward-looking measure of a company’s carbon trajectory, designed to analyse the current and future emissions intensity from direct and indirect emissions.”

The report, which indicates that LGIM has become an observer member of the Taskforce on Nature-related Financial Disclosures (see our report here), also discusses LGIM’s new biodiversity policy released in November 2021, which includes a portfolio company engagement component.

See “LGIM adds biodiversity to stewardship goals” (Pensions & Investments) and additional information & resources on our Institutional Investors page »LGIM.

This post first appeared in the weekly Society Alert!