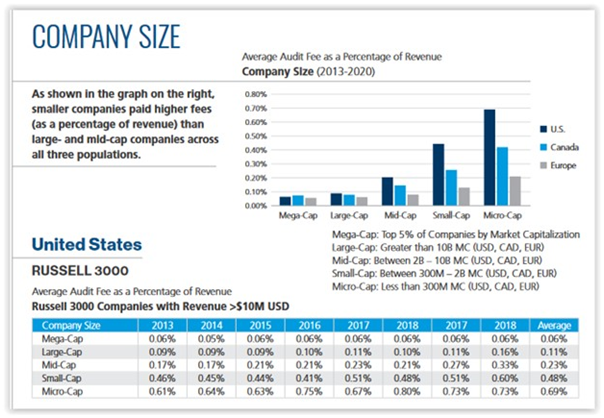

In addition to the fact that the average audit fees as a percentage of revenues for Russell 3000 companies (>$10 million in revenues) are considerably higher than the average audit fees for companies listed on the Toronto Stock Exchange and the major European exchanges, smaller companies are significantly disproportionately impacted in every jurisdiction. According to the International Federation of Accountants’ newly published “Audit Fees Survey 2022,” average audit fees as a percentage of revenue for Russell 3000 companies are 0.69%, compared to 0.06% for mega-caps and 0.11% for large-caps, as shown in the graph and table below.

By industry, average audit fees as a percentage of revenue over the period 2013-2020 were significantly higher for Manufacturing sector companies compared to all other industries analyzed, with Retail sector companies incurring the lowest fees. Average fees by the state of companies’ headquarters location are also reported, with California coming in at #1 (highest average fees as a percentage of revenue, at 0.68%) and North Dakota bringing up the rear (0.13%), over that same time period.

By industry, average audit fees as a percentage of revenue over the period 2013-2020 were significantly higher for Manufacturing sector companies compared to all other industries analyzed, with Retail sector companies incurring the lowest fees. Average fees by the state of companies’ headquarters location are also reported, with California coming in at #1 (highest average fees as a percentage of revenue, at 0.68%) and North Dakota bringing up the rear (0.13%), over that same time period.

The report also analyzes costs for non-audit services across jurisdictions, company sizes, and industries.

Access additional resources on our Audit & Audit Firms pages.

This post first appeared in the weekly Society Alert!