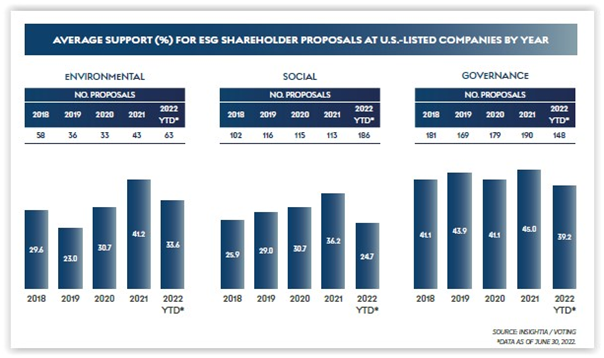

Insightia’s “ESG Appetite Dims” shows the decline in support for a record number of ESG shareholder proposals voted at US companies this season to date (as of June 30, 2022) compared to 2021.

The firm attributes the decline in shareholder support to several factors, including the global energy shortage and the adoption by energy sector companies of advisory say-on-climate votes (as respects climate-related proposals), and concerns among some institutional investors that proposals have become overly prescriptive and constraining (see, e.g., our reports on BlackRock and State Street, here and here, respectively), which is attributed at least in part to the SEC’s policy shift in November 2021 (reflected in Staff Legal Bulletin No. 14L) that rescinded the longstanding company-specific approach to Rule 14a-8’s “ordinary business” exception and replaced it with a “broad societal impact” approach.

The firm attributes the decline in shareholder support to several factors, including the global energy shortage and the adoption by energy sector companies of advisory say-on-climate votes (as respects climate-related proposals), and concerns among some institutional investors that proposals have become overly prescriptive and constraining (see, e.g., our reports on BlackRock and State Street, here and here, respectively), which is attributed at least in part to the SEC’s policy shift in November 2021 (reflected in Staff Legal Bulletin No. 14L) that rescinded the longstanding company-specific approach to Rule 14a-8’s “ordinary business” exception and replaced it with a “broad societal impact” approach.

The SEC’s more ESG-friendly stance towards Rule 14a-8 no-action letters is partly to blame for this. In November, the U.S. regulator revealed that it will no longer exclude proposals that “raise issue with a broad societal impact, such that they transcend the ordinary business of the company."

Conscious of the impact that this new ruling would have on ESG proposals, investors filed ESG proposals in abundance ahead of the 2022 proxy season. As of June 30, 2022, 139 no-action letters were filed with the SEC, compared to 295 throughout 2021.

Notably, while ISS’s support for ESG shareholder proposals is more than 2x Glass Lewis’s (at 74.7% and 37.3%, respectively, as of June 30), both reflect a reduction in support (i.e., vote “for” recommendations) compared to the prior four proxy seasons (since 2018).

See our recent report: “2022 Shareholder Proposal Round-Up”; “Investors rally behind climate, diversity proposals as proxy season ebbs” (Roll Call); and numerous additional resources on our Proxy Season 2022 and Shareholder Proposals pages.

This post first appeared in the weekly Society Alert!