The Task Force on Climate-related Financial Disclosures (TCFD) released its 2022 Status Report.

More than 1,000 additional organizations reportedly pledged support for the recommendations since last year’s status report, which now totals 3,900+ supporters globally consisting of regulators and governmental entities, financial institutions, companies, and others.

Among the key takeaways for fiscal year 2021:

Disclosure prevalence—Based on a review of 1,434 companies that reported in each of 2019, 2020, and 2021, only 4% disclosed across all 11 recommended disclosures. However, 40% disclosed in line with at least five, and 80% disclosed in line with at least one, of the recommended disclosures. On average, companies addressed 4.2 of the recommended disclosures. The disclosure rate among North American companies specifically averaged 29% across all 11 recommended disclosures compared to 20% in 2020 and compared to a range of 25% to 60% worldwide.

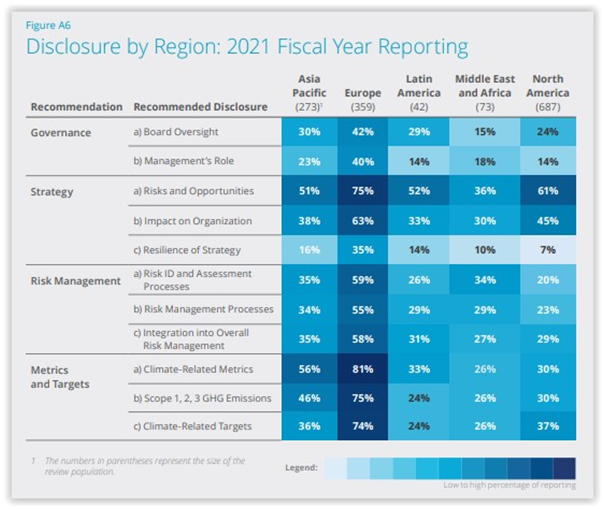

Most common disclosures consistent year-over-year—Consistent with prior years, of the 11 TCFD recommendations, companies most commonly disclosed information about climate-related risks and opportunities in their 2021 reports. The jurisdictional breakdown is here:

On par with prior years, disclosure of the resilience of companies’ strategies under different climate-related scenarios remained the least prevalent worldwide and in North America specifically.

On par with prior years, disclosure of the resilience of companies’ strategies under different climate-related scenarios remained the least prevalent worldwide and in North America specifically.

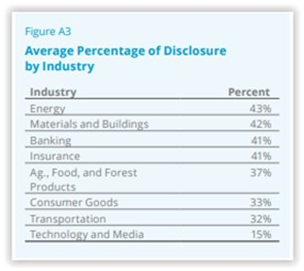

Disclosure varies by industry—Disclosures varied in frequency and focus across the eight industries reviewed, with Energy companies having the highest disclosure rate across all 11 recommendations. However, looking at discrete disclosure topics, Materials & Buildings companies, for example, led in disclosure on Scope 1, 2, and 3 GHG emissions and Climate-Related Targets (58% and 57%, respectively, for Materials & Buildings companies, compared to 48% and 56%, respectively, for Energy companies).

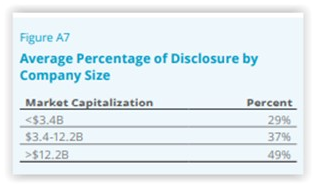

Disclosure varies by company size—Not surprisingly, the rate of TCFD-aligned reporting corresponds with company size, with 49% of companies with market caps greater than $12.2B making TCFD-aligned disclosure compared to 37% of companies with market caps of $3.4B–$12.2B, and 29% of companies with market caps below $3.4B.

Disclosure varies by company size—Not surprisingly, the rate of TCFD-aligned reporting corresponds with company size, with 49% of companies with market caps greater than $12.2B making TCFD-aligned disclosure compared to 37% of companies with market caps of $3.4B–$12.2B, and 29% of companies with market caps below $3.4B.

Sample disclosures reflecting all of the 11 TCFD recommendations are set forth on pages 20 – 29 of the report.

Sample disclosures reflecting all of the 11 TCFD recommendations are set forth on pages 20 – 29 of the report.

See the TCFD's release; these articles: “Only 4% of companies met all TCFD requirements, survey finds” (Responsible Investor), “TCFD Update Finds More Companies Providing Climate-Related Disclosure, Driven by Investor Demand” (ESG Today), “More companies disclosing climate information, but more progress needed, task force says” (Pensions & Investments), and “Climate-related disclosures increasing but more transparency needed, says TCFD” (IR Magazine); and additional resources on our Climate Risk & Disclosure page.

This post first appeared in the weekly Society Alert!