SquareWell's recent study* of the 50 largest asset managers' practices and approaches to ESG, stewardship, and activism, revealed these and other noteworthy findings:

- Sustainable investing—Nearly all of the asset managers are signatories to the UN PRI; 94% publicly support the TCFD; 82% have joined the Climate Action 100+; 58% are members of SASB; and 30% are signatories to the Workforce Disclosure Initiative.

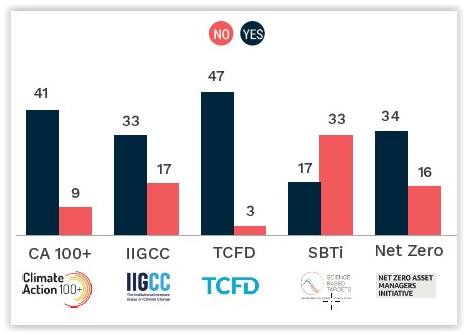

- Climate-specific initiatives—This bar graph shows how many of the 50 largest asset managers support each of the referenced climate-related initiatives:

- ESG ratings—Nearly all of the asset managers use at least one ESG ratings firm and data provider; more than half use at least four— most commonly, MSCI (92% of asset managers), Sustainalytics (76% of asset managers), and ISS-ESG (58% of asset managers). The vast majority of asset managers (90%) have also have developed their own proprietary ESG rating systems.

- Proxy advisors—Based on Squarewell’s internal database and voting analysis, 45 of the 50 asset managers use ISS as their primary proxy advisor and five rely on Glass Lewis. However, the degree of reliance on proxy advisors varies, with just 6% exhibiting a high degree of reliance on their primary proxy advisor’s voting recommendations, compared to nearly half that exhibit a low degree of reliance.

- Voting policies—Squarewell’s analysis of the asset managers’ voting policies revealed majority or substantial minority views across a number of hot topics, including the following:

- Board gender diversity—78% of the asset managers have policies that require a minimum number of women on their portfolio companies’ boards.

- Executive overboarding—66% of the asset managers have policies on executive overboarding, with half of those limiting executive board service to one outside directorship

- ESG-linked pay—A sizeable minority of asset managers (~43%) expect ESG-linked executive pay (short- or long-term incentive plans).

- Say-on-climate—While 44% of asset managers have disclosed a formal position on their approach to say-on-climate proposals, only two asset managers (Aviva Investors and LGIM) support the Children’s Investment Fund Foundation (CIFF) Say on Climate campaign launched in 2019 (see our 2021 report: “Climate: Investors Speak!”).

*Request the complimentary report: "A Look at the World’s Largest 50 Asset Managers" through the firm's website here. The investors that participated in the study are listed in the report’s Appendix.

This post first appeared in the weekly Society Alert!