This CLS Blue Sky blog post: “How Does Board-Shareholder Engagement Really Work?“ summarizes the results of a Spring 2022 survey of 171 Russell 3000 and S&P 500 public company corporate secretaries, general counsel, and investor relations officers about their board-shareholder engagement practices currently or in the preceding 12 months, and a related analysis of public company shareholder engagement disclosures and benchmarking data, undertaken by representatives of The Conference Board, Rutgers Law School, and the Department of Law of Bocconi University.

Among the key takeaways:

How often?—Looking at the total sampling of companies without regard to size, a plurality of companies reported having had no engagement with their investors in the preceding 12 months. However, company size matters, with a plurality of S&P 500 companies (39%) having engaged with their investors between two and five times over the past 12 months, compared to just 30% of Russell 3000 companies. A plurality of Russell 3000 companies (39%) did not engage with their investors over the preceding 12 months.

Who is involved?

- Shareholders—Among both the Russell 3000 and S&P 500, companies most often engage with private sector asset managers such as BlackRock, Vanguard, and State Street, followed by hedge funds and pension funds. Retail investor engagement is rare. Some companies disclose the scope of the shareholder engagement by percentage of shares engaged, while others disclose the number of shareholders engaged.

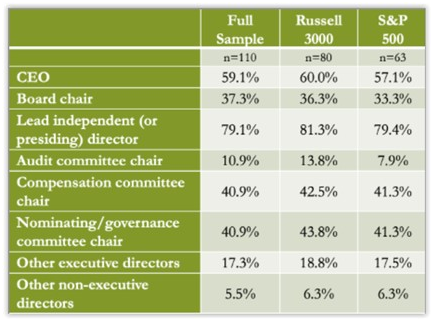

- Companies—Lead independent directors and CEOs are the most commonly involved board members in companies' shareholder engagements.

Who leads the process varies widely by company (even within index groups).

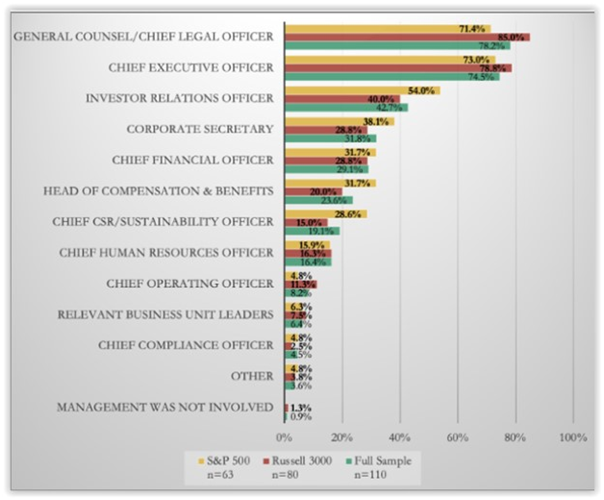

Among members of management, the GC/CLO is most often involved in the engagements:

What is discussed?—While shareholder engagements cover the full gamut of topics, executive compensation, climate and greenhouse gas emissions, and board diversity were identified as the most prevalent engagement topics. More than 16% of respondents indicated that engagements on executive compensation and environmental policy issues had increased significantly over the past three years.

What is discussed?—While shareholder engagements cover the full gamut of topics, executive compensation, climate and greenhouse gas emissions, and board diversity were identified as the most prevalent engagement topics. More than 16% of respondents indicated that engagements on executive compensation and environmental policy issues had increased significantly over the past three years.

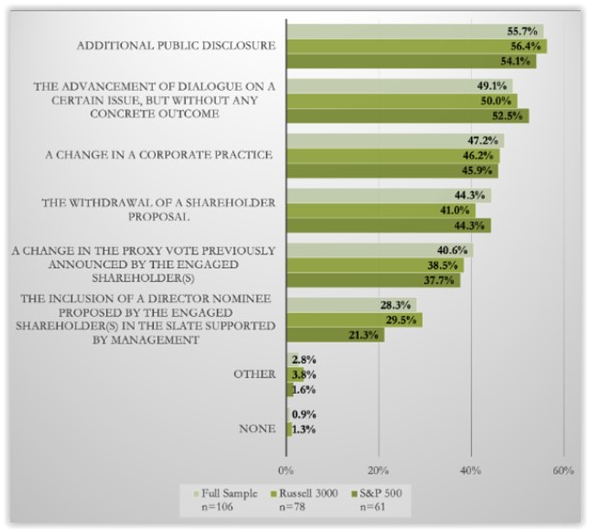

What is the result?—A majority of companies indicated that their engagements resulted in additional public disclosure; however, a substantial minority reported other meaningful outcomes, as shown here:

The detailed results are available in the full draft paper here.

The detailed results are available in the full draft paper here.

Access additional resources on our Shareholder Engagement page.

This post first appeared in the weekly Society Alert!