The jointly-released CAQ/Audit Analytics: “Audit Committee Transparency Barometer” (online here) reveals these (among other) upticks in voluntary audit committee disclosure practices and associated examples of effective disclosure based on S&P 1500 proxy statements filed from July 1, 2021 - June 30, 2022.

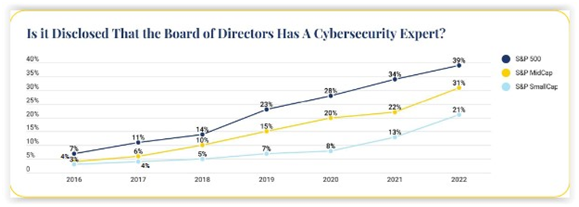

Cybersecurity oversight. Consistent with heightened risk and stakeholder scrutiny, cybersecurity oversight disclosure continues to measurably increase.

- 54%, 41%, and 32% of S&P 500, S&P MidCap, and S&P SmallCap companies, respectively, disclosed in their 2022 proxies the audit committee's responsibility for cyber risk oversight - up from 46%, 34%, and 24%, respectively, in 2021, and 11%, 5%, and 4%, respectively, in 2016.

- 39%, 31%, and 21% of S&P 500, S&P MidCap, and S&P SmallCap companies, respectively, disclosed in their 2022 proxies whether the board has a cyber expert - up from 34%, 22%, and 13%, respectively, in 2021, and 7%, 4%, and 3%, respectively, in 2016.

See the sample disclosures on pages 28-29 in Appendix II.

Audit committee's considerations in (re)appointing the external auditor. 46%, 32%, and 24% of S&P 500, S&P MidCap, and S&P SmallCap companies, respectively, disclosed in their 2022 proxies the audit committee's considerations in (re)appointing the external auditor, up from 44%, 31%, and 24%, respectively, in 2021, and 13%, 10%, and 8%, respectively, in 2014. See the sample disclosures on pages 20-24 in Appendix II.

Frequency of evaluation. 35%, 20%, and 19% of S&P 500, S&P MidCap, and S&P SmallCap companies, respectively, disclosed that the evaluation of the external auditor is conducted at least annually (best practice), up from 32%, 20%, and 17%, respectively, in 2021, and 4%, 3%, and 4%, respectively, in 2014. See the sample disclosures on pages 20-24 in Appendix II.

ESG Oversight. This year’s report also features four new questions (which will continue to be benchmarked going forward), including two relating to ESG, as follows:

- Audit committee ESG oversight: 18%, 10%, and 7% of S&P 500, S&P MidCap, and S&P SmallCap companies, respectively, disclosed that the audit committee is responsible for ESG oversight.

- Board ESG expertise: 39%, 26%, and 18% of S&P 500, S&P MidCap, and S&P SmallCap companies, respectively, disclosed that the board has an ESG or sustainability expert.

See the sample disclosures on pages 30-31 in Appendix II.

Appendix II of the report includes additional sample disclosures; Appendix III provides examples of robust comprehensive proxy disclosure; and Appendix IV includes questions for audit committees to consider in relation to enhancing disclosure in this area.

See the CAQ’s release and additional resources on our Audit Committees and Annual Meeting/Proxy Statement pages.

This post first appeared in the weekly Society Alert!