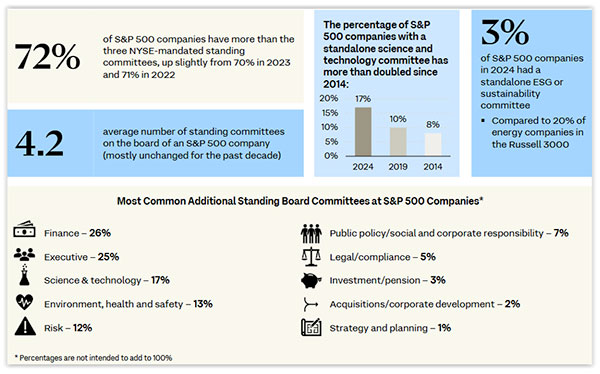

In addition to a robust summary of shareholder proposal activity, “Trends and Updates from the 2025 Proxy Season” from Freshfields includes a wealth of benchmarking information on board practices as they relate to ongoing and trending investor focus areas, including board committee structure (see below), composition, and refreshment, and board and management diversity, as well as relevant regulatory and other developments, no-action letter statistics, major institutional investor and proxy advisor policies on board diversity, director overboarding, and other key topics.

The firm identifies these among the key proxy season takeaways and trends for the Russell 3000 for the period January 1, 2024 – June 16, 2025:

- Fewer shareholder proposals coupled with reduced levels of shareholder support for E&S proposals and continued support for traditional governance and compensation proposals

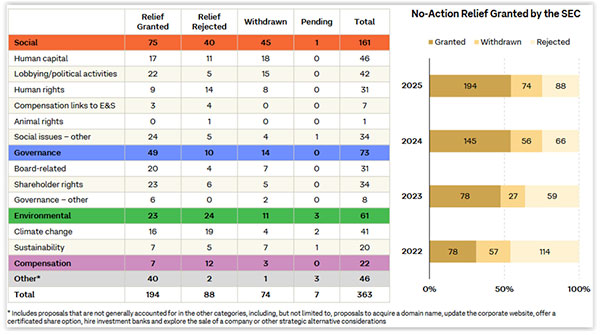

- A significant uptick in no-action requests submitted, together with a rise in the percentage of requests granted and proposals withdrawn by proponents (as a percentage of requests for no-action relief), as detailed here:

- Tempered shareholder engagement prompted by new 13D-G guidance issued in February 2025

The report is replete with colorful graphics and other visual features that promote suitability for inclusion in a management or boardroom presentation on these governance trends and other topics.