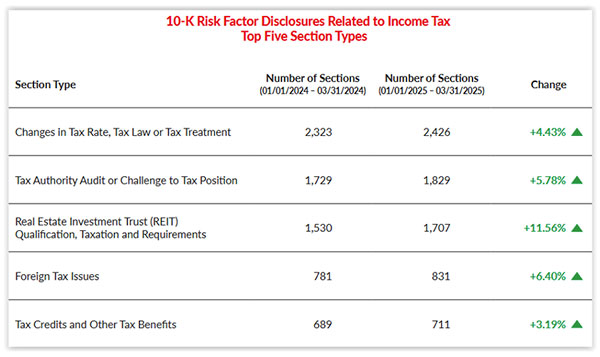

In the context of FASB’s adoption in December 2023 of enhanced tax disclosure requirements (Accounting Standards Update (ASU) 2023-09, Income Taxes (Topic 740) - Improvements to Income Tax Disclosures), Intelligize reported on income tax-related Form 10-K risk factor and other disclosure trends and shareholders’ push (via shareholder proposals and otherwise) for tax transparency. Intelligize notes the rise in Form 10-K risk factor disclosure of particular topics, as shown here:

The report includes examples of tax transparency shareholder proposals and the corresponding no-action determinations, tax-related material weakness disclosures, and recent disclosures regarding the expected impact of adoption of the new accounting standard.