The Conference Board, in collaboration with KPMG, Russell Reynolds, and the Weinberg Center for Corporate Governance, reported on the uptick in director overboarding policies and how the policies have evolved substantively over the past five years as of June 15, 2025, based on data from ESGAUGE.

Among the key takeaways:

Prevalence — Overboarding policies have increased in prevalence from 68% to 86% among the S&P 500 and from 44% to 58% among the Russell 3000 (R3000) from 2020 to 2025.

There is a positive correlation between company size and the existence of a director overboarding policy, with between 6% and 11% of large- and mega-cap companies disclosing no policy vs. 61% of micro- and nano-caps.

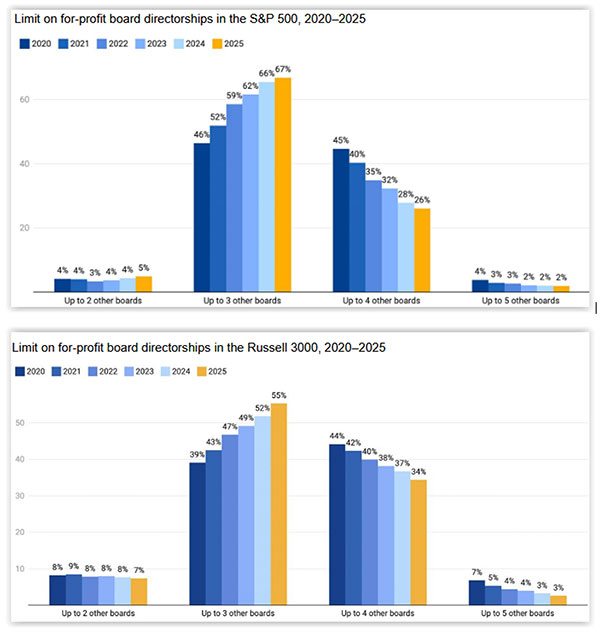

Overboarding limits — S&P 500 and R3000 companies have increasingly adopted an overboarding policy limit of up to three for-profit directorships (i.e., limiting directors from serving on more than three additional boards), representing 67% of S&P 500 companies and 55% of R3000 companies with overboarding policies as of June 2025. At the same time, the prevalence of limits allowing service on up to four or five other boards has steadily declined among both company groups since 2020.

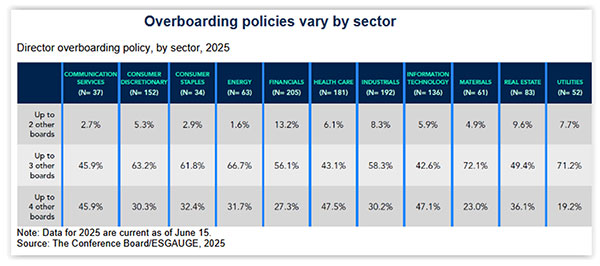

Notably, overboarding limits also tend to vary by sector, as shown here, presumably reflecting, at least in part, industry-specific regulatory and other demands:

In practice, half of R3000 directors and 34% of S&P 500 directors serve on no additional for-profit boards, while 31% of R3000 directors and 39% of S&P 500 directors serve on just one additional board.

CEO overboarding — Companies have increasingly imposed limits on board service for their CEOs of one other directorship (68% of S&P 500 companies and 64% of the R3000 as of 2025). Whereas nearly half of these companies permitted CEOs to serve on up to two other boards in 2020, the percentage of companies with a two-board limit has dropped to 30% among S&P 500 companies and 35% of R3000 companies.

The report includes a tabular summary of the overboarding policies of ISS, Glass Lewis, BlackRock, Vanguard, and State Street.