The NACD reported highlights from its Spring 2025 annual Public Company Board Practices and Oversight Survey of 201 public company directors associated with public companies across sectors and sizes.

Among the key takeaways are the following:

Board-CEO relationship (n=167-168)—More than half of respondents reported increased expectations of the CEO over the past three years, with the top four areas of scrutiny consisting of driving company performance, developing strategy, stewarding talent and culture, and managing risk.

The vast majority of respondents rated the strength of the relationship between board leadership (lead independent director (LID) or board chair) and the CEO as excellent or good. Interestingly, 71% of respondents rated the LID-CEO relationship as an “A” or “excellent” compared to 55% as respects the board chair-CEO relationship. Board-CEO relationships were also ranked as excellent by 56% of respondents, with the “A” grade most commonly associated with these three actions over the past 12-18 months: (1) acting as a sounding board during difficult decisions, (2) increasing interactions between the CEO and board chair or LID outside of board meetings, and (3) aligning board expectations of the CEO with compensation and incentive structure.

Artificial intelligence (n=146)—Up from 28% of boards in 2023, 62% of boards set aside time on the agenda for full board discussion of AI.

Other AI oversight activities conducted by a majority of boards include asking management how AI could affect the company’s future workforce needs and requesting updates about the company’s data governance practices, while nearly half of boards set aside agenda time in committee meetings and assessed risks associated with AI. More than one-third (36%) adopted an AI governance framework.

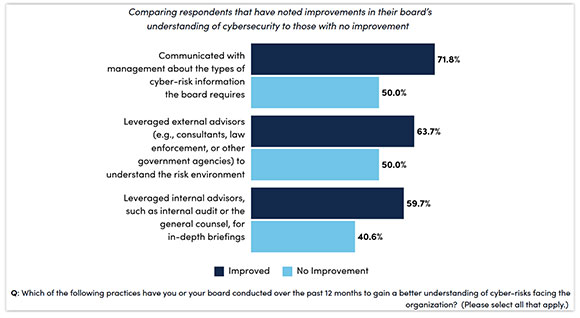

Cybersecurity oversight (n=160)—Nearly 80% of respondents reported that their board’s understanding of cybersecurity today has significantly improved compared to two years ago.

Participation in individual director educational activities over the past year to learn more about cyber-related issues has increased to 72% this year from 49% in 2022, while board discussion of the material, financial implications of a cybersecurity incident has increased to 77% from 52% over that same time period. Other AI oversight–related activities conducted by a majority of respondents or boards represented by respondents over the past year are shown here: (n=156)

Supply chain oversight (n=164)—More than half of respondents (56%) expect their company’s exposure to supply chain risks to be higher in the next 12 months; however, nearly two-thirds are very or extremely confident in their management team’s ability to deal with these challenges.

More than half of companies represented by respondents are currently focused on managing critical supply chain exposures and impacts and supply chain resiliency and contingency planning, while 42% are focused on regulatory and compliance management; about one-quarter are focused on supply chain cybersecurity and supplier strategy, including supplier diversity and concentration.