EY’s “How boards can enhance technology oversight to unlock potential” includes informative benchmarking data and insights on board technology oversight based on the firm’s review of S&P 500 technology committee charters and proxy statements and insights from the firm’s discussions with Fortune 500 directors and tech executives.

As to board oversight structure specifically:

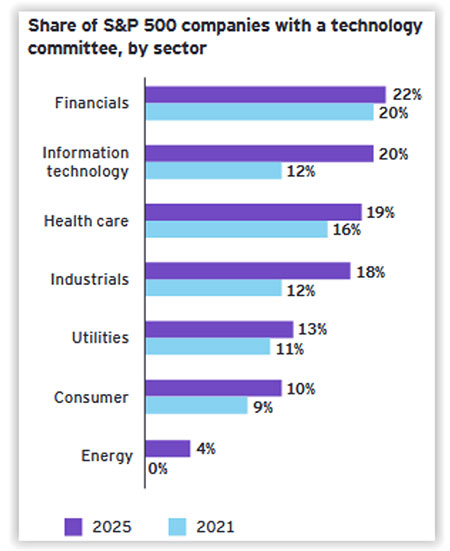

Standalone committee—Up from 7% in 2018, 13% of the S&P 500, most commonly financial services companies, have a board technology committee.

Although they vary in scope, responsibilities, and detail, these committees commonly oversee tech risks, strategies, and opportunities.

Existing committee—The balance of companies typically assign discrete tech oversight responsibilities, such as cybersecurity and AI, primarily to the audit committee. Among the S&P 500 overall, audit committees are the primary oversight body at 75% of companies; however, 42% of financial services companies task their risk committee with this responsibility.

Other approaches—The report notes other potential structural approaches including subcommittees, ad hoc committees, task forces, working groups, advisory boards, and engagement of external advisors, supported by relevant examples.

In addition to oversight structure alternatives and considerations, the report offers insights on various approaches to oversight based on and with due consideration of factors such as the company’s technology maturity, the role of technology in the company’s strategy, board expertise, board committee bandwidth, board/committee clarity of oversight responsibilities and coordination, and public disclosure, as well as technology executives’ expectations of board involvement.

See our prior report: “Board Committee Benchmarking” and additional resources on our Board Committees and Strategy pages.

This post first appeared in the weekly Society Alert!