According to Equilar, nearly 40% of the S&P 500 ("large-caps" for purposes of this Equilar study) disclosed a mandatory director retirement age in 2016 - up from just over 29% in 2012 and compared to only about 14% of small-caps (i.e., the bottom two-thirds of the Russell 3000 for purposes of this Equilar study). Ages 72 and 75 were the most frequently disclosed mandatory retirement ages, but age 75 as the retirement trigger increased in prevalence from 5.8% to 14.0% for large-caps and from 3.3% to 5.0% for small-caps over the 5-year period.

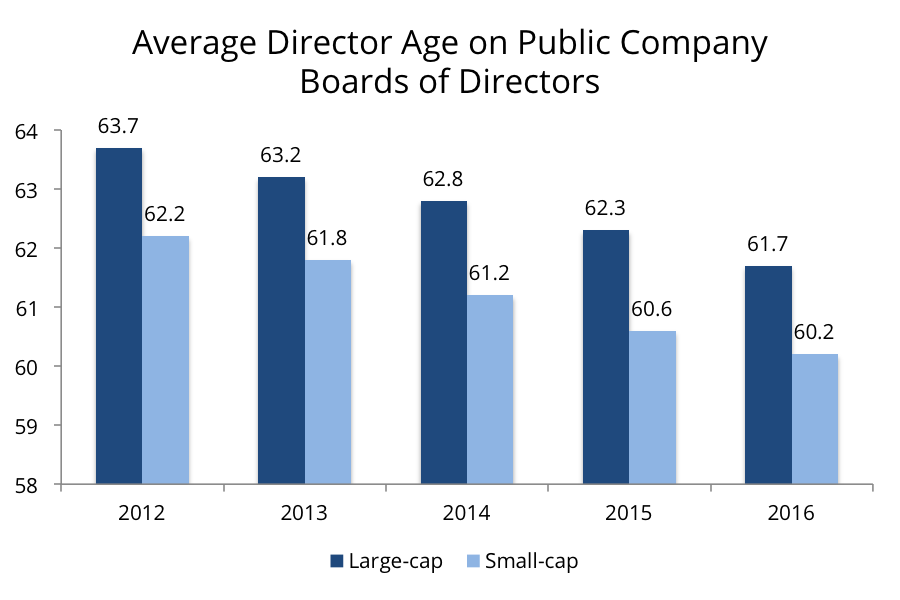

The foregoing notwithstanding, the average age of directors for both large- and small-cap companies has reportedly been declining. Large-cap directors averaged 61.7 years of age in 2016 compared to 63.7 years in 2012, and small-cap directors averaged 60.2 years of age in 2016 compared to 62.2 years in 2012. How do Society members stack up? According to the recently-released 2016 Board Practices Report, a collaborative board practices benchmarking effort between the Society and Deloitte LLP's Center for Board Effectiveness, 75% of boards overall (81% of large-caps, 74% of mid-caps, and 53% of small-caps) have age limits, with age 72 being the most prevalent (41% overall, comprised of 46% large-caps, 38% mid-caps, and 22% small-caps), followed by age 75 (33% overall - comprised of 36% large-caps, 30% mid-caps, and 22% small-caps). Notably, 33% of small-caps have mandatory retirement ages of 70 or below, compared to just 3% of large-caps. Also, 68% of boards overall are permitted to make exceptions to their retirement age, term or other tenure restriction policies.

How do Society members stack up? According to the recently-released 2016 Board Practices Report, a collaborative board practices benchmarking effort between the Society and Deloitte LLP's Center for Board Effectiveness, 75% of boards overall (81% of large-caps, 74% of mid-caps, and 53% of small-caps) have age limits, with age 72 being the most prevalent (41% overall, comprised of 46% large-caps, 38% mid-caps, and 22% small-caps), followed by age 75 (33% overall - comprised of 36% large-caps, 30% mid-caps, and 22% small-caps). Notably, 33% of small-caps have mandatory retirement ages of 70 or below, compared to just 3% of large-caps. Also, 68% of boards overall are permitted to make exceptions to their retirement age, term or other tenure restriction policies.

And more Society member boards are adding younger directors: 40% of boards overall (45% of small-caps, 42% of mid-caps, and 37% of large-caps) have directors between the ages of 41 - 50, compared to 36% in 2014.

See these reports in our previous Society Alerts: "Board Refreshment Efforts Become Apparent" and "Board Composition and Refreshment: Practice Tips" here, "Board Composition & Refreshment Practices: Industry Variations," "Investor Policies: Tenure, Term & Age Limits" in Company News & Resources here, and numerous additional benchmarking resources on our Board Succession/Refreshment, Board/Governance Practices and other relevant topical pages.

The iconic Society/Deloitte Board Practices Report - which presents findings from a survey distributed to the Society's public company members in late 2016 - covers trends in over 15 areas of board practices and hot topics including cyber risk, shareholder activism, and board diversity.