Pending broad, mandated disclosure of CEO pay ratios in 2018, ISS developed it own "outside-in" pay ratio methodology using publicly available employee and CEO data (from the US Bureau of Labor Statistics, and its own ExecComp Analytics platform for Russell 3000 CEOs, respectively) to illustrate the likely significant variations among pay ratios by industry and company size, and suggest factors investors and others consider in evaluating the reasonableness of CEO compensation once the 2018 disclosures are out.

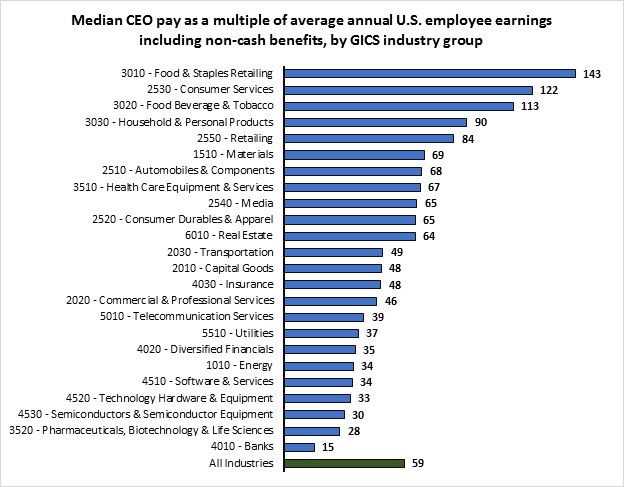

This table depicts industry variations:

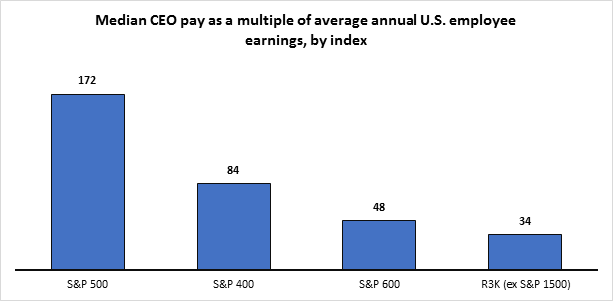

And this one shows variations by company size:

In a welcome move, ISS correctly notes that key company-specific and/or other relevant factors that don't bear on the reasonableness of the CEO's compensation (e.g., a strategically-driven workforce composition) may underlie differences in pay ratios among companies. As such, it believes institutional investors will look to companies' narrative disclosure to provide important context: "For institutional investors, narrative disclosure on the pay ratio is likely to be the most important aspect of the disclosure mandate as they look to understand the factors impacting CEO and employee pay, the drivers behind the board’s compensation-setting process, and how they reinforce the company’s management strategy."

ISS further suggests that both companies and investors use these three questions to evaluate disclosures - particularly once a mass quantity of 2018 pay ratio disclosures is out:

- How does the company’s ratio compare with peer companies?

- What is driving any difference uncovered in the ratio? Is it the CEO’s pay, the median employee’s pay, or both?

- Are there labor force issues, such as use of contractors, significant use of part-time employees, or offshore labor sourcing, that drive differences?

As previously reported, investor and company responses to ISS's annual global benchmark policy survey revealed widely divergent views between the two groups on the utility of the disclosure - with 72% of investor respondents indicating that they intend to either compare the ratios across companies/industry sectors, assess year-on-year changes in the ratio at an individual company, or both - compared to 44% of companies and other non-investors indicating that they aren't planning to use the information at all.