This new Squire Patton Boggs-led, American Council for Capital Formation-commissioned paper: 'Are Proxy Advisers Really a Problem?' reveals the results of a survey of 100 companies' experiences with proxy advisory firms during the 2016 and 2017 proxy seasons. According to the report, 35 companies across eleven industries reported 93 distinct adverse proxy advisor recommendations during that period.

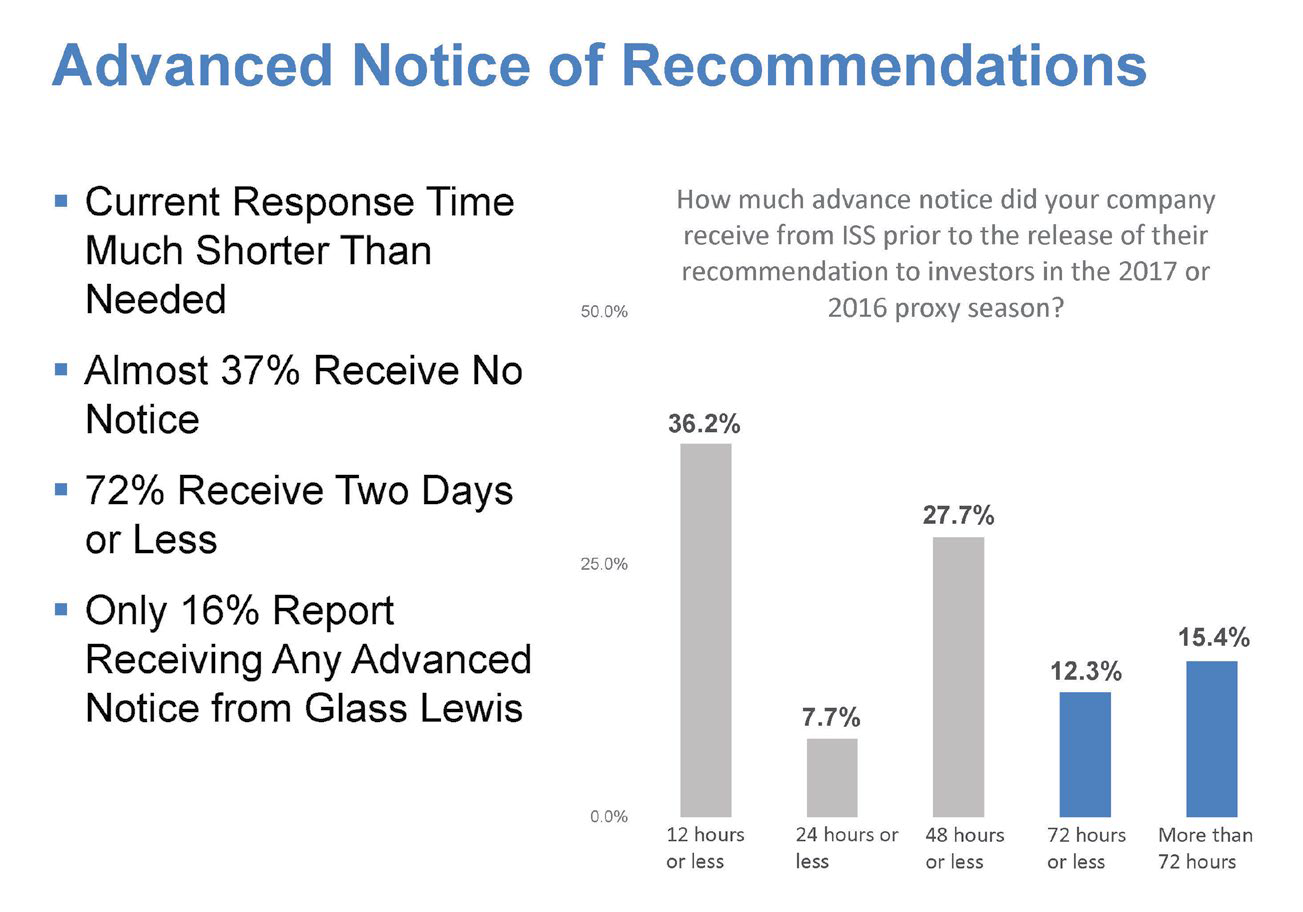

Notice & Response Time. This graphic depicts how much advance notice respondents received prior to the proxy advisory firms' release of the adverse recommendations to their investor clients:

In contrast to actual notice received (or not, as the case may be), all respondents reported needing at least three business days to effectively communicate with shareholders in response to an adverse recommendation; 68% said they would need at least five business days.

In contrast to actual notice received (or not, as the case may be), all respondents reported needing at least three business days to effectively communicate with shareholders in response to an adverse recommendation; 68% said they would need at least five business days.

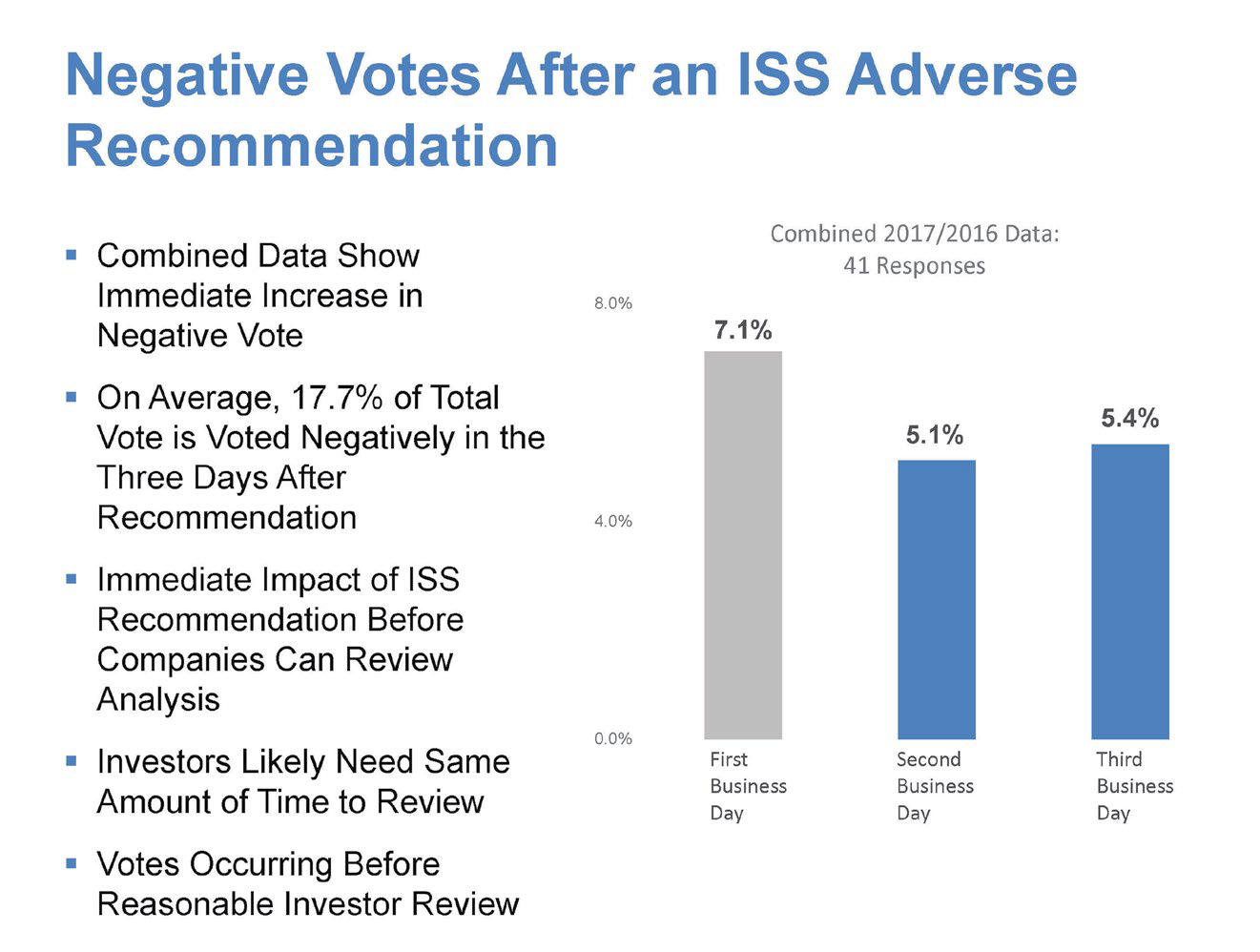

Voting Impact. As shown in the Summary Survey Results, over 19% and 15% of the total proxy votes for 2017 and 2016, respectively, were reportedly cast within three days of an adverse ISS recommendation. This graphic shows the combined 2016 and 2017 data:

Nearly 12% of the total vote was reportedly voted negatively within the three days after an adverse Glass Lewis recommendation for the 2017 proxy season (see 2016 & 2017 data on page 9 of the report).

Nearly 12% of the total vote was reportedly voted negatively within the three days after an adverse Glass Lewis recommendation for the 2017 proxy season (see 2016 & 2017 data on page 9 of the report).

Proxy Advisor Voting Report Errors. Based on a review of 107 supplemental proxy filings (which the report deems reliable due to filers' liability exposure) from 94 different companies from 2016 through September 30, 2018, there were 139 significant problems reported - including 90 factual or analytical errors, and 49 filings that expressed 'serious disputes' - detailed here.

The survey reportedly was administered by four major law firms, including Squire Patton Boggs, to their largely Fortune 100 clients.