ISS Analytics' early review of 2019 shareholder proposals through the end of February based on filed proxy statements, SEC no-action letters, and proponent-disclosed/shared proposals reveals 395 proposals filed compared to 450 filings at the same time last year, and - on par with last year - E&S proposals outnumbering governance and compensation-related proposals by a wide margin.

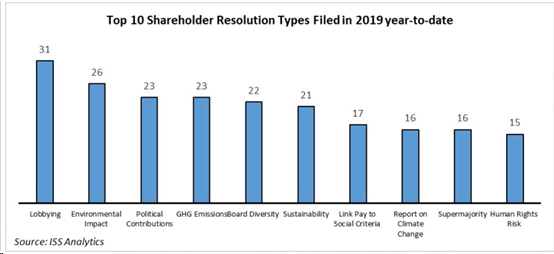

This graphic shows the top 10 proposal topics based on filings to date, which will likely change (at least in order of ranking) as the proxy season unfolds:

Based on early trends, ISS expects the trend toward higher withdrawal rates of E&S proposals based on successful proponent/company engagements to continue. Governance proposals reportedly are more likely to be omitted.

The post also illustrates the proportion of proposals by type (Environmental | Social | Governance & Compensation) filed by sector.

See also these articles: "Show Us Your Climate Risks, Investors Tell Companies" (WSJ) and "Rhode Island shareholder proposal leads to ADM greenhouse gas pact" (Pensions & Investments), and additional information & resources on our Shareholder Proposals page.

This post first appeared in the weekly Society Alert!