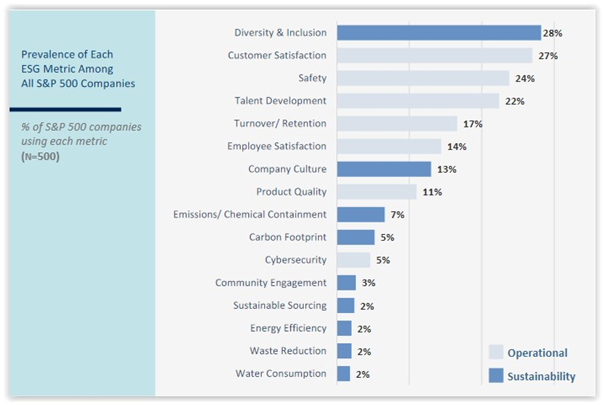

Semler Brossy's "ESG + Incentives report" benchmarks the prevalence and types of ESG metrics being used by the S&P 500 in their executive compensation programs, with the metrics most commonly used being characterized as "sustainability" metrics (i.e., longer-term broad social/economic stability, e.g., diversity and inclusion) rather than "operational" metrics (i.e., aligned with day-to-day business results, e.g., customer satisfaction). According to the report, 57% of the S&P 500 that filed their proxies between March 2020 and March 2021 included an ESG metric in their annual or long-term incentive plan.

As shown here, Diversity & Inclusion was the most prevalent metric used, followed closely by Customer Satisfaction, and Safety:

The metrics that increased in prevalence most year-over-year were those relating to Safety, Customer Satisfaction, and Diversity & Inclusion.

The metrics that increased in prevalence most year-over-year were those relating to Safety, Customer Satisfaction, and Diversity & Inclusion.

ESG metrics generally, and sustainability-related (as opposed to operational) metrics specifically, were more prevalent among the 200 largest companies in the S&P 500 than the smaller 300 S&P 500 companies.

The report builds on last year’s series of reports (which we reported on here, here, and here) that focused solely on the Fortune 200.

Access additional resources on our Executive Pay page »Non-Financial Metrics (Sustainability, DE&I, etc.).

This post first appeared in the weekly Society Alert!