Georgeson’s “An Early Look at the 2021 Proxy Season” summarizes submission, withdrawal, and voting trends at Russell 3000 companies for director elections and key environmental and social shareholder proposals for the 2021 proxy season through June 2.

Key takeaways include:

- The number of directors garnering less than 50% support is nearly 30% higher than was the case at a similar time last season, seemingly largely driven by trending issues like board diversity and ESG practices and disclosure, coupled with certain large institutional investors’ change in voting approach, as we reported on here and here.

- Although the number of shareholder proposals submitted increased 10% year-over-year, more proposals were negotiated out before the annual meeting, resulting in a comparable number of proposals going to a vote.

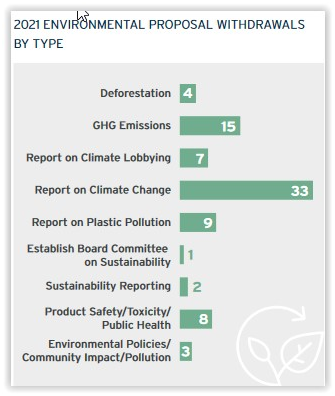

- The 12 environmental shareholder proposals that have passed involved GHG emissions (4 proposals), climate lobbying reports (4 proposals), deforestation (2 proposals), climate change reporting (1 proposal), and plastic pollution reporting (1 proposal).The number of proposals voted pales in comparison to the 82 environmental proposals that were submitted and later withdrawn, presumably based on company/shareholder engagement.

- The 18 social shareholder proposals that have passed involved political contributions reporting (4 proposals), reporting on lobbying payments and policy (4 proposals), reporting on DE&I efforts or other workforce diversity matters (4 proposals), board diversity reporting (3 proposals), EEO-1 data disclosure (2 proposals), and reporting on human rights risks in operations and supply chain (1 proposal).

- Of 91 workforce diversity proposals submitted, only 12 have been voted (six of which passed) and one is pending. The balance were withdrawn (65 proposals) or omitted/excluded from the proxy (13 proposals).

The Appendix includes a list of shareholder proposals passed as of June 2.

Access additional resources on our Proxy Season 2021 page.