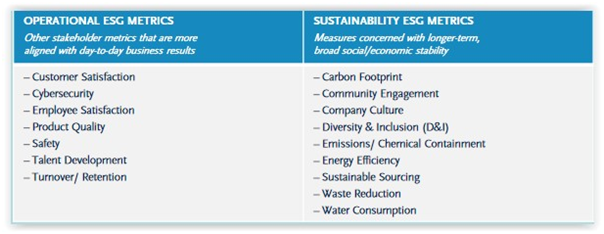

Semler Brossy's "ESG + Incentives 2021 Report" benchmarks across S&P 500 companies: (i) ESG incentive metrics by industry, (ii) (largely logical) variations across industry sectors (e.g., environmental and safety metrics concentrated among Energy, Utilities, and Materials sector companies), and (iii) rational decision-making by boards of directors in using metrics strategically to support or advance - rather than lead - corporate strategy. Metrics are broadly categorized as either “Operational” or “Sustainability” as detailed here:

The report depicts the prevalence of each of the foregoing metrics by industry for all S&P 500 companies that use ESG metrics if the prevalence of the particular metric is at least 15% within that industry, accompanied by the names of companies within each industry whose incentive plans include these metrics.

The report depicts the prevalence of each of the foregoing metrics by industry for all S&P 500 companies that use ESG metrics if the prevalence of the particular metric is at least 15% within that industry, accompanied by the names of companies within each industry whose incentive plans include these metrics.

See our recent report: “ESG Executive Compensation Metrics: Large Companies” and additional resources on our Executive Pay page »Non-Financial Metrics (Sustainability, DE&I, etc.) and Surveys/Studies.

This post first appeared in the weekly Society Alert!