Insightia reported that The Children’s Investment Fund’s (TCI) and Children’s Investment Fund Foundation’s (CIFF) say-on-climate strategy for US-listed companies will no longer seek annual shareholder advisory votes on companies’ climate transition plans, although they will continue to do so for European and Australian companies.

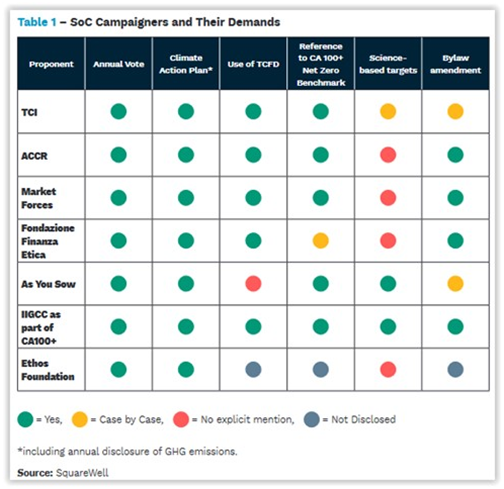

According to SquareWell Partners’ recent report: “Global Review of Say on Climate (SoC) Proposals” (which we reported on here), as the Society indicated in its response to ISS’s Benchmark Policy Survey and Climate Policy Survey, numerous institutional investors have expressed opposition to say-on-climate proposals (the substance of which varies by proponent, as shown below) as a matter of principle or address such proposals on a case-by-case approach for various reasons.

As noted in SquareWell Partners’ report, of the 10 shareholder say-on-climate proposals voted as of June 2021, just three passed (including two at the same company). ISS supported 50% and Glass Lewis supported 20% of those shareholder say-on-climate proposals.

As noted in SquareWell Partners’ report, of the 10 shareholder say-on-climate proposals voted as of June 2021, just three passed (including two at the same company). ISS supported 50% and Glass Lewis supported 20% of those shareholder say-on-climate proposals.

See our recent reports: “Proxy Advisors Weigh in on Say-on-Climate Proposals”; “Say-on-Climate Developments” ; “Say-on-Climate Considerations”; and “Vanguard Speaks! Say-on-Climate Proposals”; and additional information & resources on our “Climate Risk & Disclosure,” “Shareholder Proposals,” and “Proxy Season 2021” pages.

This post first appeared in the weekly Society Alert!