Insightia’s “Scope 3 or not Scope 3?” discusses various perspectives relevant to the current debate about whether companies should be required to, and reliably can, report their Scope 3 emissions, as well as investor pressures and support for climate change reporting generally. Although institutional investors tend to endorse Scope 3 disclosure, some appear more cognizant of current impediments, including widely accepted and reasonably accessible emissions measurement technologies, and thus support a phased implementation approach, which SEC Chair Gary Gensler has signaled (see “Climate Disclosure”) may be forthcoming.

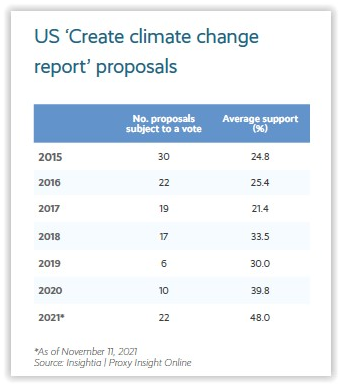

Support for climate change reporting proposals among the “Big Three” (BlackRock, Vanguard, and State Street) has skyrocketed over the past 5+ years, and within the past year in particular, while average investor support overall has doubled since 2015, as shown here:

The article cites a Boston Consulting Group study, which we reported on here (see “Accurate Emissions Measurements Appear Elusive”), indicating that more than 75% of 1,290 organizations (across sizes and industries) responding to a survey said they are unable to measure the full carbon footprint of their products and services, including product usage and end-of-life impact; respondents estimated an average error rate of 30% to 40% in their emissions measurements.

The article cites a Boston Consulting Group study, which we reported on here (see “Accurate Emissions Measurements Appear Elusive”), indicating that more than 75% of 1,290 organizations (across sizes and industries) responding to a survey said they are unable to measure the full carbon footprint of their products and services, including product usage and end-of-life impact; respondents estimated an average error rate of 30% to 40% in their emissions measurements.

See our prior report: “Scope 3 Emissions: Best Guesstimate?” and additional information & resources on our Climate Risk & Disclosure page.

This post first appeared in the weekly Society Alert!