The Society's March 2022 Sustainability Practices Benchmarking Survey garnered responses from 113 public company Society members* on a wide range of environmental and social (E&S) practices and objectives.

Among the noteworthy takeaways:

Board Oversight structure - The majority of respondents identified their Nom/Gov Committee as having primary oversight responsibility for their company’s climate and other environmental issues (64%) followed by the full board (43%), and their Compensation Committee as having primary oversight responsibility for their company’s social issues (such as diversity and inclusion, human capital, pay equity, product safety, and community relations) (68%), followed by the Nom/Gov Committee (50%).

Frequency on the agenda - A plurality of respondents said environmental-related matters and human capital management topics are most commonly on the meeting agenda (of the full board or committee charged with primary oversight responsibility, as the case may be) annually. Comparatively, more than half of respondents indicated that sustainability/ESG matters generally are on the meeting agenda at every meeting (26%) or quarterly (26%).

ERM Integration - More than 80% of respondents consider E&S issues as part of their ERM process.

Voluntary disclosure topics - 80% of respondent companies publicly disclose goals, metrics, and/or other information on E&S topics - most commonly regarding workforce diversity and/or other racial equity matters; GHG emissions; community relations, volunteerism, charitable giving; climate strategy; and human capital management.

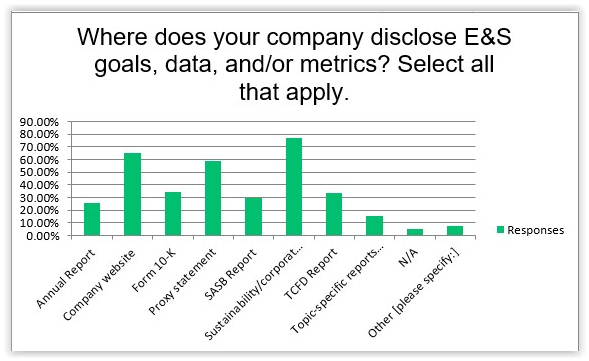

Disclosure channels - A sustainability/corporate social responsibility report and/or the corporate website are the most favored communication channels for disclosure of E&S goals, data, and/or metrics, as shown here:

Legal Department/GC role - The Legal Department/GC’s office typically has a collaborative role (61%), rather than the lead role (33%), in the E&S reporting process.

Formal disclosure controls & procedures - Nearly half of respondents either have standalone written DC&P for their voluntary sustainability reporting (22%) or have incorporated DC&P into their internal timeline for their annual meeting and proxy statement (55%).

Data/information review process - A majority of respondents said that their voluntary E&S disclosures are subject to the same legal review as their company’s financial disclosures. About one-third indicated that a disclosure committee or similar body reviews and/or approves the company’s voluntary E&S disclosure; several members clarified that their disclosure committee reviews any E&S disclosures included in their SEC filings.

Third-party assurance - About 6% of respondents whose companies publicly disclose E&S metrics have their entire sustainability/CSR report or all of such metrics assured by an independent third party; 55% said they obtain no assurance, and about one-third indicated they receive assurance for certain or material metrics. Companies most commonly look to specialty sustainability firms (as opposed to, e.g., CPA firms) for assurance.

* Respondents consisted of 58% large- and mega-cap; 27% mid-cap; and 15% small/micro/nano-cap, more than half of which were associated with the Energy, Resources & Industrials or Financial Services industries, at 36% and 24%, respectively. For data by market cap category, please contact Randi at rmorrison@societycorpgov.org.

See our 2021 survey report here and additional resources on our Sustainability/ESG page.

This post first appeared in the weekly Society Alert!