SquareWell Partners “Reframing ESG”* explains the foundational notion of corporate governance (the “G” of “ESG”) and calls for it to be disaggregated from and viewed differently than the E&S aspects of “ESG,” which has become synonymous with sustainability. The report asserts that governance has been inappropriately displaced and largely masked by investor focus on particular issues like climate change and diversity, and calls for its repositioning as a standalone pillar outside of the “ESG” lexicon. In addition to good governance being critical to establishing and fulfilling corporate purpose, strategy, performance, and accountability, it is also essential to effectively delivering on environmental and social issues.

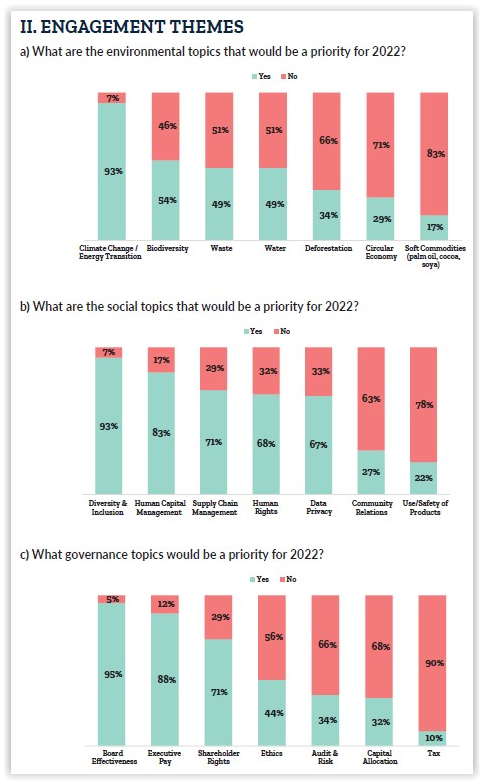

The report also shares the results of an institutional investor survey conducted in late 2021 concerning shareholder-company engagement on governance and sustainability matters. Among other things, the survey revealed investors’ environmental, social, and governance engagement priorities:

Investors overwhelmingly expect to meet with a company’s sustainability team when engaging on governance and sustainability matters (85%), followed by IR (56%). About half of respondents indicated a preference for director participation in such engagements (25% said this is a “must have” and 24% identified as a “nice to have”); the balance said it depends on the topic of discussion.

Investors overwhelmingly expect to meet with a company’s sustainability team when engaging on governance and sustainability matters (85%), followed by IR (56%). About half of respondents indicated a preference for director participation in such engagements (25% said this is a “must have” and 24% identified as a “nice to have”); the balance said it depends on the topic of discussion.

Consistent with its reframing of ESG, starting this year, the firm notes that it is repositioning itself from an “ESG advisor” to supporting its clients to be “governed in a way that ensures sustainability.”

*41 organizations, representing asset managers $25.2 trillion AUM) and owners as well as proxy advisors, participated in the survey. Request the complimentary report through the firm's website here.

See “Time to separate the G from ESG, argues SquareWell Partners” and “More than half of investors expect IR involvement when engaging on sustainability” (IR Magazine).

This post first appeared in the weekly Society Alert!