State Street’s annual stewardship report reveals these and other noteworthy statistics for 2021:

Of 878 comprehensive engagements, 64% were with U.S. companies. The top five engagement topics worldwide were (in descending order) human capital, racial equity, COVID-19, climate-related reporting, and compensation matters.

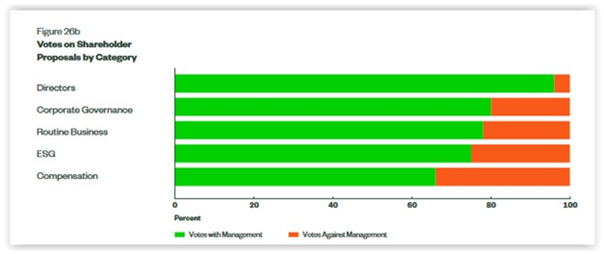

State Street voted in accordance with management recommendations on 90% of shareholder proposals (4,090 of 4,524 voted with management) worldwide. By shareholder proposal category, it voted against management’s recommendations most frequently on compensation-related proposals, followed (in descending order) by ESG, routine business, and corporate governance proposals.

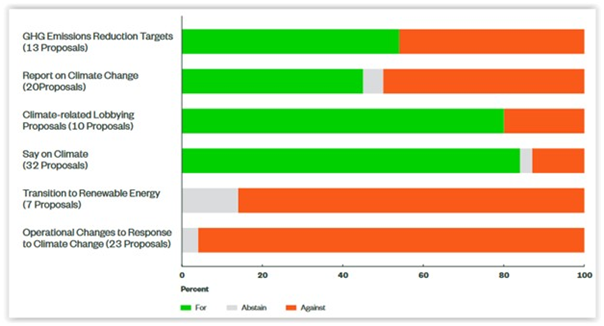

Globally, State Street engaged with 254 companies on climate change risks. Notwithstanding reservations about potential unintended consequences associated say-on-climate voting generally, it supported 84% of the 32 say-on-climate proposals that went to a vote. Its support for other climate-related proposals varied, as shown here:

Globally, State Street engaged with 254 companies on climate change risks. Notwithstanding reservations about potential unintended consequences associated say-on-climate voting generally, it supported 84% of the 32 say-on-climate proposals that went to a vote. Its support for other climate-related proposals varied, as shown here:

Notably, State Street indicates that it found many of the climate-related shareholder proposals in 2021 to be overly prescriptive.

We were not generally supportive of resolutions that required companies to make specific operational changes such as a transition to renewable energy within a defined timeframe or phasing out a project, business or product. We found the actions requested by many of these shareholder proposals to be overly prescriptive.

While we give investee companies discretion to decide what climate-related goals are appropriate for them, we will continue to monitor the rigour of such goals and engage with them to ensure that climate is meaningfully integrated into their long-term strategy.

Based on BlackRock’s recent stewardship piece that we reported on last week, the 2022 proxy season appears likely to trump 2021 in terms of the prescriptive nature of shareholder proposals that may fail to garner support from some of the largest institutional investors.

Notwithstanding the fact that U.S. companies rank higher than all other regions on State Street’s R-Factor corporate governance scores, State Street voted against ten S&P 500 companies based on their R-Factor Corp Gov scores and their supposed inability to articulate how they could improve their score (so-called “laggards”). This compares to 13 S&P 500 companies garnering a “no” vote based on their ESG-focused R-Factor score overall.

See State Street’s report “snapshot”; these recent reports: “State Street Climate Expectations & Voting,” “State Street Releases Updated Voting & Engagement Guidelines,” and “State Street Refreshes Portfolio Company Expectations & Guidance”; and additional resources on our Institutional Investors page » State Street.

This post first appeared in the weekly Society Alert!