In addition to explaining key terminology: “reissuance restatements” (also known as “Big R” restatements), “revision restatements” (aka, “Little r” restatements), and “out-of-period adjustments,” Audit Analytics’ “2021 Financial Restatements: A Twenty-One-Year Review” reveals noteworthy statistics and trends on financial restatements through 2021.

Among the key takeaways:

- Reportedly largely attributable to SEC guidance issued in April 2021, SPACs triggered a huge uptick in restatements year-over-year (289%), comprising 77% of all restatements in 2021. Excluding SPACs, the number of restatements actually declined 10% year-over-year.

- Excluding SPAC-related restatements, 24% of 2021 restatements were “Big R” restatements, representing a 3% increase from 2020. The balance were “Little r” restatements.

- Excluding SPAC-related restatements, 61% of restatements in 2021 (up nominally from last year) covered an annual report; the balance covered quarterly financials.

- Financial restatements by non-accelerated US filers comprised 73.1% of the total. Large accelerated filers and accelerated filers accounted for 10.2% and 4.5%, respectively.

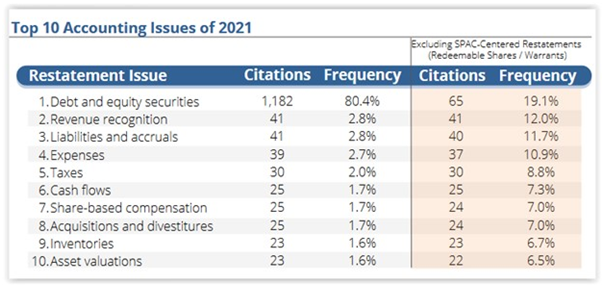

The most frequently cited issues in restatements in 2021 were as follows:

Debt and equity securities displaced revenue recognition, which was the top accounting issue annually for the past three years.

As previously reported, in connection with its reopening of the comment period for the Dodd-Frank Act clawback proposal, the SEC raised several additional questions for consideration that were not included in the initial rule proposal, including whether the scope of the final rule should be expanded to cover “Little r” restatements, which the Society advised against.

See Audit Analytics’ post; “Restatements surge to 15-year high on SPAC filings” (CFO Dive); and additional resources on our Financial Reporting page. SPAC resources are posted on our M&A page.

This post first appeared in the weekly Society Alert!