Stanford’s “ESG Ratings - A Compass Without Direction” provides an instructive overview of the ESG ratings landscape generally, as well as a summary of several of the big-name ESG research and ratings providers including MSCI, ISS ESG, Sustainalytics, Refinitiv, and FTSE Russell. Coverage includes investor and other stakeholder demand for ESG data; the purported objectives of ESG ratings; the various methodologies, scopes, rating scales, and data sources; and structural industry characteristics that may further contribute to data quality and integrity concerns.

Notably, the paper provides updated data on the correlations (or lack thereof) across ESG ratings providers, which reflects the significant variations in raters’ methodologies (reportedly largely due to differences in measurement and scope much more so than weighting differences), and supports concerns companies and other market players have raised about the use of ratings for investment or proxy voting-related decision making.

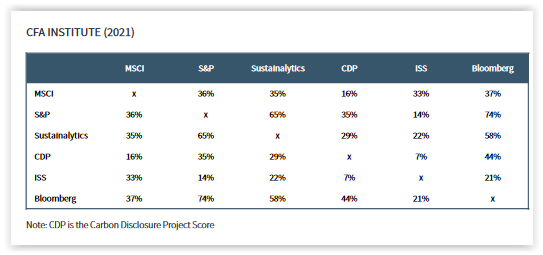

The table below shows the low correlation of scores across ratings providers. For example, ISS ESG ratings have a 33% correlation with MSCI; a 14% correlation with S&P; a 22% correlation with Sustainalytics; a 7% correlation with CDP; and a 21% correlation with Bloomberg.

Another table included in the paper depicts correlations across providers and by category (“E,” “S,” and “G”).

Another table included in the paper depicts correlations across providers and by category (“E,” “S,” and “G”).

The guide, which is aimed at educating companies, investors, and regulators about ratings that are typically marketed to investors, makes clear that although ESG ratings are responsive to market demand, the drawbacks are considerable and arguably outweigh any potential purported upsides.

See these posts: “What’s wrong with ESG ratings?” (Cooley), “Zeroing In On The Problem With ‘ESG’” (The D&O Diary), and “3 Reasons Why ESG Ratings Still Matter and Will Remain Relevant” (Clermont Partners); these articles: "Inside the world of ESG ratings: Academic paper looks at multiple issues with process and outcomes" (IR Magazine) and “ESG as Economic Threat Catches on as Theme in Key Senate Race” (Bloomberg Law); our prior reports: “ESG Ratings Variances Increase” and “ESG Ratings are in the Eye of the Beholder”; and numerous additional resources on our Sustainability page - Ratings/Raters.