Society public company members across sizes and industries* responding to the most recent Society / Deloitte Board Practices Quarterly survey: “Back to basics: Board education and evaluations” provided insights on their board and board committee education and evaluation practices, both of which are deemed critical tools to ongoing board effectiveness in the context of an extraordinarily dynamic regulatory and business climate.

Among the takeaways:

Board education program—A majority of respondents (60%) indicated that their board’s ongoing director education program is provided in-house by management, and includes specific education topics added to regular meeting agendas (68%) and an unlimited advancement or reimbursement policy for attendance at director education programs offered/hosted by third-parties (61%). Nearly half (48%) reported that their board education is provided in-house by a third party.

Board/committee education topics—Most boards are provided education across numerous topics, including more traditional topics such as fiduciary duties and oversight responsibilities and insider trading, as well as relatively “newer” focus areas such as cyber, DE&I, and climate. Board committee education topics are more commonly tailored to the committee’s remit, for example, new accounting pronouncements and/or auditing requirements and financial and liquidity risk aimed at the audit committee; DE&I aimed at the compensation committee; and shareholder engagement/activism aimed at the nominating and governance committee.

Evaluation scope—Most boards conduct full board evaluations (95%) and committee evaluations (94%), while nearly 40% of evaluations include director self-evaluations and director peer evaluations.

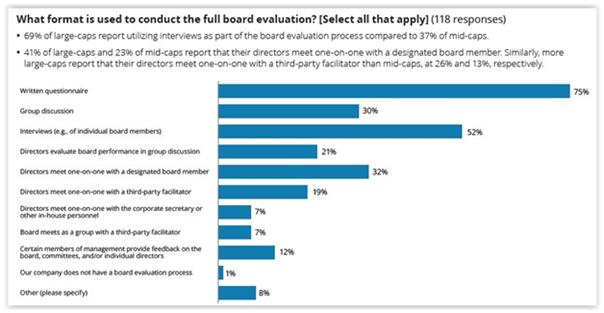

Evaluation format—Boards most commonly use written questionnaires and interviews to conduct their evaluations.

Evaluation facilitator—Evaluations are most commonly facilitated by either the board chair or another director (56%) or the corporate secretary or other in-house personnel (55%). Third-party facilitators are used by 20% of boards, and 15% said they periodically change their facilitation approach (e.g., periodically use a third-party facilitator).

Evaluation facilitator—Evaluations are most commonly facilitated by either the board chair or another director (56%) or the corporate secretary or other in-house personnel (55%). Third-party facilitators are used by 20% of boards, and 15% said they periodically change their facilitation approach (e.g., periodically use a third-party facilitator).

Board evaluation topics—Most board evaluations regularly address all of the “traditional” evaluation topics including board composition; committee structure, composition, and scope; board meeting formats and meeting materials; board dynamics and culture; board oversight/accountability; board-management dynamics; board and committee leadership; and company/industry knowledge.

Board evaluation disclosure—Companies commonly disclose information about their board evaluation process and methodology (73%). Other aspects of the evaluation such as goals and objectives, board evaluation topics, outcomes, and the resulting action plan, are relatively infrequently disclosed.

*Public company respondent market capitalization as of December 2021: 48% large-cap (which includes mega- and large-cap) (>$10 billion); 59% mid-cap ($2 billion to $10 billion); and 3% small-cap (includes small-, micro-, and nano-cap) (< $2 billion) (excluded from report due to limited response rate). Respondent industry breakdown: 32% energy, resources, and industrials; 30% financial services; 19% consumer; 10% life sciences and health care; and 9% technology, media, and telecommunications.

Responses tended to vary by company size. Access the survey results online and by company size and type here.

Access additional resources on our Board/Director Education and Board/Director Evaluations pages.

This post first appeared in the weekly Society Alert!