Insightia’s “Proxy Voting Season Snapshot 2022” shares instructive shareholder and management proposal voting data concerning the five largest institutional investors— BlackRock, Vanguard, State Street, Fidelity, and JPMorgan.* The changes in support year-over-year for environmental and social shareholder proposals are particularly noteworthy.

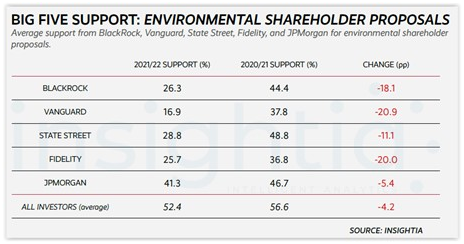

Average support among the “Big Five” of environmental shareholder proposals declined by more than 15%, ranging from JP Morgan at the low end (down 5.4%) to Vanguard at the high end of the range (down 20.9%), as shown here:

Average support of social shareholder proposals declined by more than 13%, ranging from JP Morgan at the low end (down 6.9%) to BlackRock at the high end of the range (down 20.1%):

Average support of social shareholder proposals declined by more than 13%, ranging from JP Morgan at the low end (down 6.9%) to BlackRock at the high end of the range (down 20.1%):

More specifically, average support by the Big Five for diversity and EEO-1 proposals declined by an average of nearly 11%, ranging from a drop of about 6% (State Street) to nearly 37% (BlackRock). In contrast, changes in support levels for racial equity and diversity audit proposals were mixed, ranging from increased average support from State Street of nearly 24% to a decline in average support of more than 50% from BlackRock.

More specifically, average support by the Big Five for diversity and EEO-1 proposals declined by an average of nearly 11%, ranging from a drop of about 6% (State Street) to nearly 37% (BlackRock). In contrast, changes in support levels for racial equity and diversity audit proposals were mixed, ranging from increased average support from State Street of nearly 24% to a decline in average support of more than 50% from BlackRock.

*The data covers US- and Canadian-based issuers for meetings from July 1, 2021 – June 30, 2022.

The report precedes Insightia’s always eagerly anticipated October Proxy Voting Annual Review.

See these prior reports: “BlackRock's Support for Climate Shareholder Proposals Likely to Drop in 2022,” “State Street: Director Accountability Trumps Shareholder Proposal Support,” and “Vanguard Speaks! Shareholder Returns Remain Paramount,” and additional resources on our Proxy & Annual Reporting Season 2022 page.

This post first appeared in the weekly Society Alert!