Shearman & Sterling's recently released report on its annual "Corporate Governance & Executive Compensation Survey" contains an abundance of benchmarking data for the 100 largest US public companies (listed at the end of the report) based on publicly available resources as of June 1, 2022, as well as a focused review of—and practical guidance—on a number of hot topics, including climate change, E&S proposals and disclosure, and ESG-linked pay.

The report's deep dive on sustainability disclosure practices is particularly noteworthy in view of the broad stakeholder focus on various sustainability issues. Key benchmarking results include:

- All 100 companies issued a CSR report, most commonly titled "Sustainability/Environmental Report" or “ESG Report,” and usually in the form of a single report (which includes ESG-dedicated websites).

- Of the 68 companies that identified a publication date, a plurality published their report after the issuance of their annual report but before or on the date of their annual shareholders meeting.

- A majority of companies covered the following topics in their report (in descending order of prevalence): sustainability, employee support, diversity, climate change/net zero initiatives, supply chain, community support, safety, human rights, corporate governance, ethics, human capital, privacy and data security, aligning corporate responsibility to long-term strategy, veteran support, and citizenship.

- Of the nearly three-quarters of companies that disclosed having set a net zero carbon/GHG emissions target, reduction targets ranged from 15% - 75% and/or upstream net zero, and target dates ranged from 2025+ to 2050 and beyond. Nearly all companies disclosed Scope 1 and 2 emissions and nearly three-quarters disclosed Scope 1, 2, and 3 emissions.

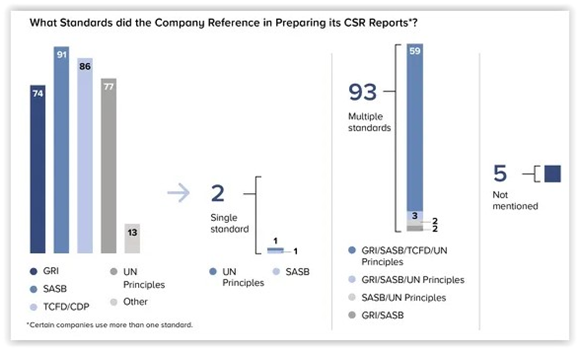

- Of those CSR reports that identified reporting frameworks/standards, most referenced multiple ones, as shown here:

- 70% of companies disclosed having a “Chief Sustainability Officer” (or other officer with a similar title).

- Nearly 75% of companies identified ESG factors as among the board’s skill sets in their director skills matrix or narrative in their proxy statement - most commonly, human capital/talent management and development (60 companies) and/or environment/sustainability (37 companies).

- Just six companies did not disclose the board’s oversight of ESG matters in their proxy statement.

- Of the majority of companies that disclosed their oversight structure, boards typically oversee ESG at both the board and committee levels. For those boards whose oversight structure includes a board committee, allocation of responsibility to the Nom/Gov Committee is the most common approach by a wide margin, although more than half of companies disclosed a dispersed approach (i.e., multiple committees).

- More than half of companies disclosed ESG oversight in committee charters or their corporate governance guidelines.

See the release and numerous additional benchmarking resources on our Board/Governance Practices, Annual Meeting/Proxy Statement, and other topic-specific pages.

This post first appeared in the weekly Society Alert!