BlackRock released its annual “Investment Stewardship Annual Report” (summary here), which captures its proxy voting-focused stewardship activities for the 12 months ended December 31, 2024.

Key takeaways include:

Globally, BlackRock supported about 11% of 857 shareholder proposals voted in 2024. This commentary is noteworthy:

The number of proposals focused on climate and natural capital issues (environmental) or company impacts on people (social) outnumbered governance proposals, largely driven by activity in the U.S. market. In our assessment, the majority of these were over-reaching, lacked economic merit, or sought outcomes that were unlikely to promote long-term shareholder value. A significant percentage were focused on business risks that companies already had processes in place to address, making them redundant.

In addition, within this same set of proposals, we saw a greater number seeking to roll back company efforts to address material sustainability-related risks. We determined that these proposals were also overly prescriptive or lacked economic merit. In our analysis, we considered each company’s policies, practices, and disclosures, as well as the balance between the costs and benefits of addressing the business risk, the merits of the proponent’s request, and long-term financial value creation for shareholders, such as BlackRock’s clients. BIS did not support any of these proposals.

More specifically, BlackRock supported about 20% of governance-related shareholder proposals (73 of 357); ~4% of social (company impacts on people) proposals (15 of 327); and ~4% of environmental (climate and natural capital) proposals (6 of 173). As noted above, the primary reason BlackRock did not support social and environmental shareholder proposals was because of its determination that companies already had processes in place to address the risks.

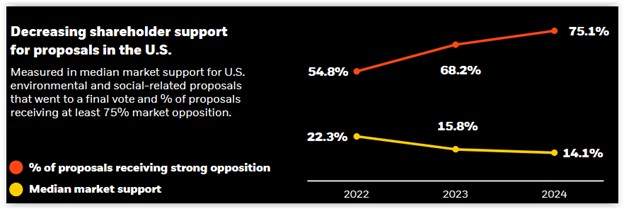

Approximately 83% of the environmental and social shareholder proposals voted were in the US, which have increasingly garnered low support.

BlackRock supported ~90% of director elections globally. The primary reasons BlackRock did not support certain directors in 2024 were concerns regarding director independence, board composition, executive compensation, and director overcommitment. More generally, BlackRock supported 88% of management recommendations on management proposals.

The report also includes numerous engagement and other voting statistics by topic and by region, case studies, and more.