"What Directors Think"—from Corporate Board Member, Diligent Institute, and FTI Consulting—reveals the results of a September/October 2024 survey of more than 200 US public company directors about upcoming challenges and opportunities in the context of ongoing domestic, geopolitical, and macroeconomic volatility.

Among the key takeaways:

Board oversight—Asked to select the top three issues they find most challenging to oversee in the role as a director today, respondents identified strategy and executive succession planning (42% and 30%, respectively), followed by cybersecurity/data privacy (falling from its #1 spot for several years) and capital allocation (27% and 25%, respectively).

Board composition—Directors ranked industry and customer expertise, C-suite experience, and digital / technology expertise (including AI / Generative AI) as the three most critical attributes for their board’s next new directors.

Management in the boardroom— Notably, asked who they would like to hear more from in addition to the CEO and CFO, more than one-third of director respondents identified the Chief Human Resources Officer, more so than any other C-Suite officer (including the GC). (See our recent report: “Chief Human Resources Officer Engagement with the Board.”)

Significant strategic risks—Nearly 70% of directors said that the sudden departure of the CEO or other mission-critical individuals would have a significant or nonrecoverable impact on their company strategy (69% and 1%, respectively), with an additional nearly one-quarter noting some impact. The impacts of a major cybersecurity incident are a fairly close second in terms of strategic risk.

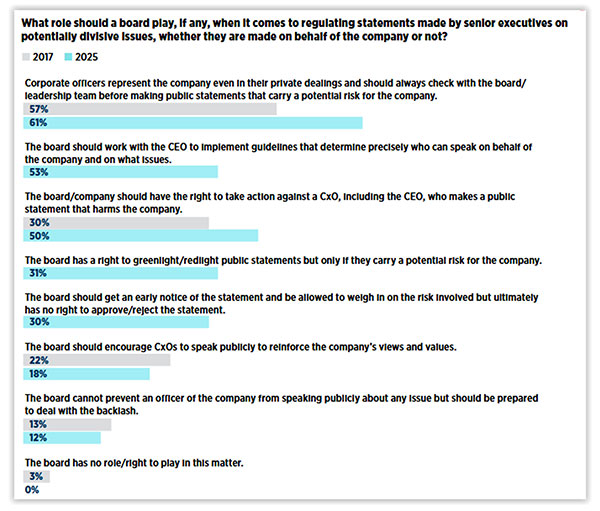

Speaking out on divisive issues—The vast majority of directors (85%) believe that, in today’s polarized political and social climates, there is greater risk of losing customers by taking a stance on an issue, whereas the percentage that believe refraining from taking a stance is the riskier approach has declined from 29% in 2017 to 15% today (based on the 2024 survey). Most say that the company has a policy that identifies which individuals, if any, can make public statements on the company’s behalf and addresses the where, when, and how; however, directors’ views about the appropriate scope of the board’s involvement vary, as illustrated here:

Shareholder activism—A majority of directors noted that their boards monitor financial metrics (revenue and earnings growth and TSR), the alignment of executive pay and performance, and communications with major shareholders to help determine the company’s vulnerability to shareholder activism. A not insignificant 38% indicated that they monitor engagement with proxy advisers, while 11% said that they don’t monitor shareholder activism at all.

Respondents represented companies of all sizes and industries, committee representations, and board tenure (p20).