Georgeson’s recap of the 2025 proxy season includes a plethora of informative and instructive data on Russell 3000 shareholder proposals for annual meetings held July 1, 2024 - June 30, 2025, with comparisons to the prior two proxy seasons.

Among the key takeaways:

- Of the 840 identified shareholder proposals submitted, 42% were governance-related, 27% were social-related, 16% were environmental-related, and 15% were anti-ESG. Of the 495 (59% of submitted) voted proposals, 51% were governance-related; 33% were social-related; and 17% were environmental-related.

- Three-quarters of all proposals submitted targeted (by order of prevalence) the Consumer, Tech, Healthcare, Financial Services, and Industrials sectors, while an equal percentage were aimed at the S&P 500.

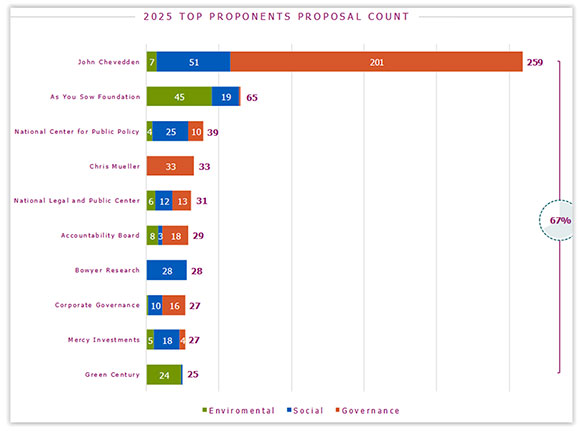

- More than two-thirds of proposals were filed by 10 proponents, with John Chevedden leading the pack by a wide margin at 259 proposals.

- Average support declined to a three-year low for environmental and social proposals (~15% and ~18%, respectively, this season, down from ~24% and ~23%, respectively, in 2023) and remained high for governance proposals (~35% on par with 2024). Passage rates for environmental and social proposals were also very low at 0% for environmental proposals and 2.5% for social proposals, in stark contrast to the 18% passage rate for governance proposals.

- Average support for directors reached a three-year high at 95.3% for Russell 3000 companies and 96.5% for the S&P 500, with 95%+ support for 72.5% and 77.4% of directors, respectively.

The report includes a recap of no-action relief submissions and determinations.

Access additional resources on our Proxy Season 2025 page.

This post first appeared in the weekly Society Alert!