Teneo’s review of 250 of the S&P 500 sustainability reports published January 1 through July 30, 2025, revealed noteworthy insights, statistics, and trends, including:

Communications-related

- Average page count has fallen to 2021 levels at 70 pages from 83 pages in 2024; 82 in 2023; and 77 in 2022.

- Use of press releases to announce report publication has declined to 36% of companies in 2025 from a high of 76% in 2021.

- Disclosure of ESG microsites has remained high at 92 (from 95% last year).

- Inclusion of ESG data tables has remained generally on par with the past two years at 57%, which is down from 75% in 2021.

- Reports were most commonly published in June, April, July, and May (28%, 24%, and 16% for each of July and May, respectively).

Content-related

- Companies overwhelmingly use or reference SASB (92%), followed by the TCFD (86%), GRI (70%), and UN SDGs (60%).

- External assurance (predominantly provided for environmental data) has increased from 53% in 2021 to 67% in 2025.

- External assurance providers are most commonly not associated with the Big Four.

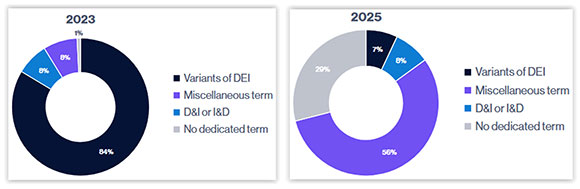

- DEI-related nomenclature has changed dramatically since 2023, as shown here:

- 72% of reports referenced a materiality assessment, down from 79% last year, but up from 52% in 2021.

- A majority of reports (52%) included a materiality matrix and a legal disclaimer (53%).

- The percentage of reports including a standalone section on the company’s progress on its ESG goals continued to decline to 30% this year from 36% last year and 46% the year before.

Governance-related

- Report cover letters are most commonly from the CEO only (58%).

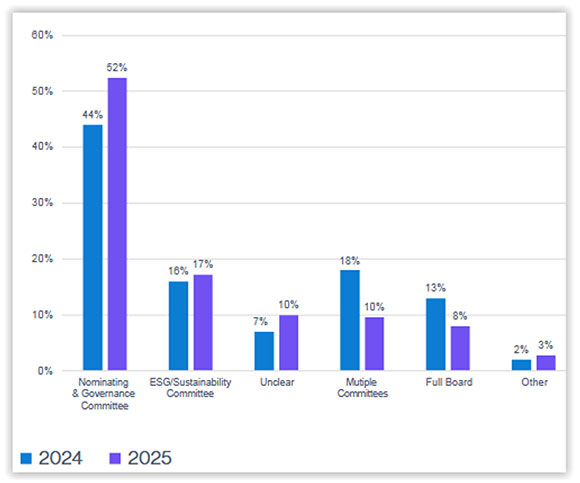

- Companies most commonly identify their nom/gov committee as having primary board ESG oversight responsibility.

- Among the management team, CEOs are most commonly tagged with primary ESG oversight responsibility (28%), followed by the Chief Sustainability Officer (21%) and General Counsel (16%).

Access additional resources on our Sustainability page.

This post first appeared in the weekly Society Alert!