According to Pearl Meyer, based on recent poll data, executive security practices and governance are lagging the current threat environment. The October/November 2025 survey of 258 respondents from public, private, and not-for-profit organizations* revealed the following takeaways (among others):

Program prevalence — Nearly two-thirds of companies have no formal CEO security program; 13% have implemented limited/situational measures (e.g., event or travel only); 12% have a modest, formal program (e.g., basic home security, cyber/digital security); and just 9% have comprehensive/multi-layered programs (e.g., physical + home + cyber/digital + family security measures).

Types of security measures — CEO security programs most commonly include cyber/digital protection measures (70%), followed by home security (54%), private air travel (53%), and non-air travel personal protection (45%). However, companies most commonly identified personal protection, excluding air travel (e.g., secure ground transport, bodyguards), as their highest priority for CEO security (44%), followed by cyber/digital protection (37%).

Scope of coverage — While company-provided security protections are most commonly limited to the CEO (39%), nearly one-third of companies also cover select other executives, while 22% extend protections to the full executive leadership team.

Risk assessment — Only 10% of companies engage formal independent threat assessments vs. 73% that rely on management/board judgment to determine their security needs, which the firm suggests may signal a reality/perception gap as respects modern day security risks.

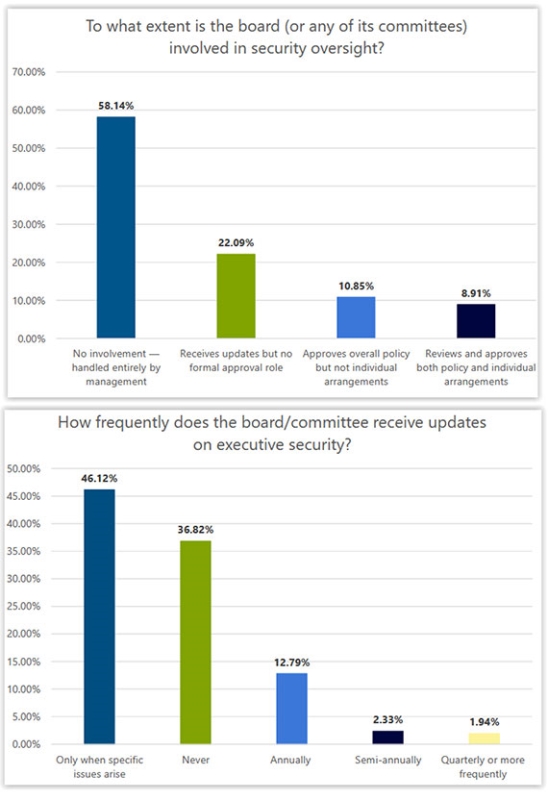

Board oversight – The majority of boards have no involvement in overseeing executive security and rarely receive updates (either at the board or committee level). The firm notes that the data suggests potential vulnerability, with companies treating security as an operational item rather than a governance risk.

Disclosure - Two-thirds of companies spend less than $10,000 annually on CEO security, which the firm suggests undervalues the risk exposure, while 10% spend $200,000+. Proxy disclosure challenges include determining whether to treat executive security costs as a perk vs. a business expense and balancing disclosure detail with executive safety concerns, among others, with a plurality of companies treating such costs as a business expense rather than a perk.

* Respondent demographics: 125 public | 84 private | 49 not-for-profit/government; 62% US-only | 33% global but with less than 50% of revenue generated outside the US; numerous industries represented with a bent toward the financial/insurance industry (31%)