The Center for Political Accountability reported increased institutional investor support for its model corporate political disclosure resolution: 63% support in the 2025 proxy season, up from 60.8% support in 2024, based on the 48 largest institutional investors included in the analysis.

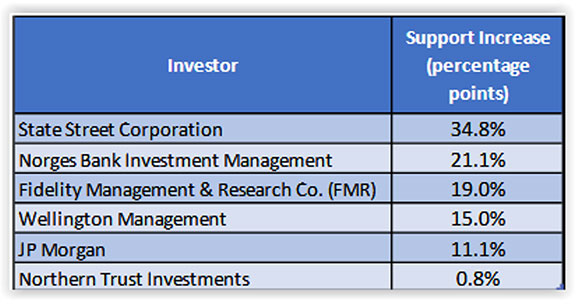

Among the Big Three, BlackRock supported three; Vanguard supported zero; and State Street supported 10, of 13 proposals voted. Of the largest 16 asset managers, which include the Big Three (≥ $1 trillion AUM), six (including State Street) increased their support season-over-season, as shown here:

Overall, support for the proposal by the largest 16 asset managers lagged support by the other 32 asset managers (less than $1 trillion AUM) by a large margin, at 45.6% vs. 73.4%, respectively.

The report includes tables that show the level of support by each of the 48 largest investors in 2023, 2024, and 2025, and the greatest swings in support from 2024 to 2025.

See our recent reports: “How to Manage Political Activity Shareholder Proposals” and “Board Oversight of Political Contributions & Activity Disclosure” and additional resources on our Political Contributions & Disclosure page.

This post first appeared in the weekly Society Alert!